By: James Scott

“Carbon pricing strategies are the invisible hand of the market, guiding us from the precipice of ecological disaster to the pathways of sustainability.“

Introduction

Green Conflict Minerals — Climate change represents a looming threat that could cause the displacement of several billion people and, consequently, human and economic catastrophe. Therefore, the effort to limit the global rise in temperatures to 2oC under the Paris Agreement (UNFCC, 2018) and mitigate the effects of climate change represents the singular most important challenge human civilization has faced in its history.

A wide variety of technologies aiming to accomplish that are being developed and deployed, and their application requires resources that can be limited in supply.

The IEA estimates that “a concerted effort to reach the goals of the Paris Agreement (climate stabilization at ‘well below 2°C global temperature rise’, as in the IEA Sustainable Development Scenario [SDS]) would mean a quadrupling of mineral requirements for clean energy technologies by 2040. An even faster transition, to hit net-zero globally by 2050, would require six times more mineral inputs in 2040 than today.” (IEA, 2022)

The main factor is the increased use of electric vehicles and batteries, which is predicted to increase thirty times by 2040. Lithium should see the highest increase in materials used for manufacturing by 2040, over 40 times, followed by graphite and nickel (20-25 times). Copper demand is slated to double due to the expansion of the global electrical grids. Cobalt consumption is estimated to increase 6 to 30 times, depending on the evolution of battery technology and the stringency of climate policies. Rare earths should see an increase of 3 to 7 times, depending on how widely wind power generation is adopted. Largely, these wide margins of uncertainty are due to a general need for more well-defined long-term policies.

The total consumption of minerals critical for green technologies is expected to increase from around 8 million tons in 2020 to 30-40 million tons by 2050, creating significant opportunities in the field. As a result, this mining sector’s value is expected to increase from around $40 billion to over $250 billion in annual revenue. For comparison, today’s global coal mining sector is worth around $420 billion in annual revenue.

In the near term (by 2030), the supply outlook is mixed: the supply of some minerals like mined lithium and cobalt is expected to meet or surpass demand, while for others like rare earths, lithium chemical products, or battery-grade nickel, the demand is expected to exceed current and planned production significantly. The existing operations, planned expansions, and new operations are expected to meet only half the demand for lithium chemical products and cobalt and around 80% of the demand for copper.

This highlights the lack of urgency on the supply side of climate change mitigation and the relatively long time it takes to develop mining projects from the first deposit discovery to full exploitation (around 15 years). Environmental concerns regarding large mining projects also tend to delay these projects, as local communities are concerned with the impact the operations will have on the local environment.

Resources vital to mitigating climate change and not found locally abundant are now classified as critical minerals. Critical minerals, in general, are defined by current dependence on imports of minerals necessary for security and economic prosperity, usually with limited domestic sources and, therefore, dependence on one or few trading partners. For the US, these critical minerals are assigned yearly by the US Geological service. They include aluminum, chromium, cobalt, graphite, lithium, manganese, nickel, rare earths, titanium, vanadium, and zinc (USGS, 2022).

Critical minerals vital to green technologies are collectively named green energy minerals and they include: Aluminum (Wind, solar and batteries), Chromium (Wind and batteries; also hydro and geothermal), Cobalt (Batteries), Copper (Wind, solar and batteries; also hydro, geothermal), Graphite (Batteries), Iron (Wind and batteries), Lead (Wind, solar and batteries; also hydro), Lithium (Batteries), Manganese (Wind and batteries; also hydro and geothermal), Molybdenum (Wind, solar and batteries; also hydro and geothermal), Nickel (Wind, solar and batteries.

Also hydro and geothermal), Rare Earths (Wind), Silver (Solar), Titanium (Geothermal; potential use in experimental battery and solar technology), Vanadium (Batteries), Zinc (Wind, solar and batteries; also hydro), Antimony (Potential use in an experimental large-scale energy storage), Cadmium (thin-film PV technology), Gallium (thin-film photovoltaic (PV) technology), Germanium (transistors for electronic devices), Indium (thin-film PV technology), Niobium (experimental solar and battery technologies), Platinum (hydrogen-based fuel), Selenium (thin-film PV technology), Silicon (photovoltaic cells), Tantalum (electric cars and other electronic applications), Tellurium (thin-film PV technology), Tin (electronics, automobile components) (Church, 2020).

At the intersection of critical and green conflict minerals lies a group of materials that are vital to green technologies and either already in short supply or estimated to become in the next ten years. Moreover, the minerals’ supply is likely the decisive factor in the success of the effort to mitigate climate change. Without sufficient supply, no policy or technology will be able to achieve the goals of the Paris Agreement and limit the global temperature rise to 2oC. Therefore, it is worth examining the state of their global supply (location, production capacities), strategic implications, and most likely scenarios for the future regarding their availability.

Clean Energy Technologies | Green Conflict Minerals

Solar Power Generation

Solar power technologies convert natural sunlight into usable energy, either electric or thermal. Sunlight is the only naturally occurring energy source: every other form of energy we consider “energy” used in our economy, including fossil fuels, represents previously-stored solar energy. In addition, solar energy is an abundant source – Earth’s surface receives around 174 million gigawatts of solar energy. Clouds, oceans, and land absorb around 70% of it.

In general, when it comes to climate change mitigation, electric power generation from solar energy is considered one of the foundations of any future low-carbon or zero-carbon economy. The conversion of solar power to electricity is conducted by photovoltaic (PV) solar cells, which absorb a portion of solar energy and convert it to electricity. However, these have two significant drawbacks: they can, obviously, only operate during daylight, and their power output is not constant – it fluctuates both during the day and seasonally, depending on the weather. Therefore, PV systems must be coupled with an energy storage system (batteries or hydrogen storage) to make them an effective electric power source for the economy.

The primary material for PV cells is silicon, both crystalline and polycrystalline, one of the most abundant elements on Earth. Around 28% of the Earth’s crust by mass is silicon, and its most well-known forms are quartz, silica, and glass (all are silicon oxides). In addition, silicon is a component in many ores mined and refined to extract other minerals. However, due to the chemical stability of its compounds, high melting temperature, and chemical reactivity, high-purity silicon requires considerable processing. Impurities and defects in crystalline silicon cause inefficiencies in PV cells.

Other PV technologies do not use silicon under development. However, given the need for widespread use, the wide availability and abundance of silicon, and the established technology for its production, it is likely that silicon PV technology will remain the mainstay of PV systems for the next several decades and be the chief contributor to the climate change mitigation effort.

Current PV systems recover the energy invested in their manufacturing in less than two years, providing excess clean energy for 25 or more years of operation (1:20 to 1:30 ratio), making them suitable as the main power source for a future economy. For comparison, fossil fuels produce around 100 times more energy than invested in their extraction and processing. In addition, the price per watt of rooftop systems has been steadily declining as the economies of scale and technological improvements allowed cheaper production of PV systems. It is currently $1-2 per watt, which makes it competitive with fossil fuels and other energy sources.

Global Levelized cost of operation for utility solar energy has been estimated to be $30 to $70 per MWh ($130 to $190 for residential), compared to $80 to $120 for offshore wind power, $40 to $60 for on-shore wind power, $20 to $70 for hydroelectric power, $60 to 110 for coal power plants, $60 to $70 for gas/oil combined cycle power plant, $60 to $100 for geothermal power, and $70 to $170 for nuclear power.

Wind Power Generation

Wind power generation is a method that uses wind turbines to generate electricity. It is a sustainable and renewable energy source with a relatively small environmental impact. On-shore (based on land) wind farms produce cheaper electricity than fossil fuel power plants, while offshore wind power generation is more expensive but provides a more stable output. However, their power output is variable, depending on wind speeds, which varies both with the weather and seasonally, which means that they need to be coupled with industrial-scale energy storage to provide a large stable power output. In 2021, wind farms’ global installed power capacity was estimated to be around 800 GW, accounting for around 6% of global electricity production.

However, the annual increase in installed capacity was around 100 GW, which was still below the number needed to achieve Paris Agreement goals for 2050 (around 1% of global electricity production, or 150 to 200 GW annually over the next ten years).

Wind power generation has been used for centuries in the form of windmills. However, modern wind turbines are significantly more efficient. A wind turbine’s theoretical energy conversion limit is 59% (the Betz limit). Modern turbines achieve 70-80% of this theoretical limit. The materials used for turbine rotor blades are typically glass and carbon fibers or composites. Hybrid designs use a mix of materials to lower production costs, adding nano-engineered polymers and composites. Other turbine parts are usually steel or aluminum (which reduces the weight and makes turbines more efficient), while copper is required for generators, cables, and other electrical components. Increasingly, variable speed generators containing magnetic materials like neodymium are used to replace the step-up gearboxes.

Although wind power depends on local conditions and is not widely available, it represents an important component of the future zero-carbon economy. In addition, there are countries and regions with particularly favorable conditions where wind power could represent a major component in the local power supply. Therefore, there will be a growing demand for new wind power installations and, consequently, a growing demand for critical minerals necessary for producing wind power generation facilities.

Energy Storage

There are three realistic energy storage solutions: biomass, battery storage, and hydrogen storage. Biomass accumulates energy in the organic material that can be burned later to release the stored energy in a controlled manner to provide thermal energy, which can be converted to electrical energy. However, biomass has severe scale limitations to provide a viable global energy storage solution. Moreover, it is limited to converting direct solar energy from sunlight to organic material, making it impractical for storage of other sources of energy, like wind or photovoltaic.

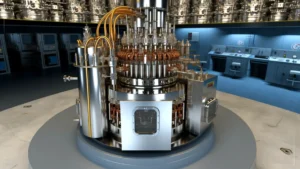

Battery storage is a form of electrochemical energy storage where energy is converted to chemical energy that can easily be converted back to electricity. This makes it very convenient to use, as electricity can easily be used to convert to other forms of energy. A rechargeable battery is a form of battery storage that can be used repeatedly through charging and discharging cycles.

Rechargeable batteries have become commonplace, and the most widespread type is known as lithium-ion batteries. They have an energy density of 250-700 Wh/L and use lithium cobalt oxide as cathode and graphite as anode material. Other potential derivatives could use lithium iron phosphate, lithium manganese oxide, or lithium nickel manganese cobalt oxide as alternative cathode materials. Alternatives to graphite as anode materials include lithium titanate, hard carbon, tin-cobalt alloy, and silicon-carbon composite. Some of these materials are expected to be the mainstay of renewable energy storage, especially in mobile applications like vehicles and electronics.

Lithium, cobalt, and copper are critical minerals in battery technology. Lithium is the key component in any commercially available high energy-density technology and most of those under development. Therefore, there will be a consistent long-term increase in lithium demand due to the expansion of battery technology applications. Copper is not used directly in battery technology but as a conductor material in electrical circuits that include batteries. As such, it is irreplaceable (its alternatives are gold and silver), and as battery technology replaces fossil fuel technologies, it is expected that copper demand will continue to increase consistently over the next thirty years.

Hydrogen storage represents the only viable energy storage alternative to battery technology. A wide variety of available hydrogen storage technologies can broadly be separated into two categories: physical and chemical storage. Physical storage includes compressed and liquefied hydrogen storage and various methods of physical storage of hydrogen inside different materials like metal-organic frameworks, porous or layered carbon, or capillary arrays. Chemical hydrogen storage involves binding hydrogen chemically in a compound that can easily be decomposed to release hydrogen and then reconstituted to recharge hydrogen.

Common methods include metal hydrides (lithium, magnesium, sodium aluminum, lithium aluminum), alanates (aluminum tetrahydrogen ion), and various organic compounds. As an alternative to gasoline for mobile applications, hydrogen is significantly safer, is very unlikely to ignite on impact, and does not burn as easily as fossil fuels.

Both hydrogen storage and batteries have much slower charging speeds than fossil fuels. For example, it takes a few minutes to replenish a full gasoline tank, while recharging a battery or rehydrogenating a storage material takes much longer – in best cases, 15-20 minutes, or worse, hours. Therefore, while these methods can easily be utilized for industrial energy storage, there is a continuing effort to improve the charging-discharging cycle to approach as much as possible flexibility of fossil fuels.

Carbon Capture and Storage

In general, there are three principal methods for carbon capture, depending on how the CO2 stream is generated in the process:

Post-combustion: CO2 is removed from the exhaust after fossil fuel combustion, typically using a solvent to capture the CO2. This technology is most commonly used and can be retrofitted to existing applications (Parliamentary Office of Science & Technology, 2009).

Pre-combustion: The fuel is converted to a mix of carbon monoxide and hydrogen (syngas) through a reaction with steam and air, and carbon monoxide is converted to CO2, which can then be sequestered, while hydrogen is used to generate power.

Oxy-fuel combustion: The fuel is combusted in oxygen instead of air, which produces a gas containing a high concentration of CO2 (80%). Cooling the gas leaves an almost pure stream of CO2 sequestered.

When it comes to the separation of CO2 from the stream, there is a relatively large number of proposed technologies: membranes, absorption, adsorption, cryogenic, chemical looping combustion, etc. However, the most widely used technology is chemical absorption using amines, like monoethanolamine. This is the only technology used on an industrial scale.

Finally, carbon storage can be conducted in several ways. Geological storage (supercritical CO2 is injected into underground geological features and stored physically). Algae or bacteria could be used to gradually decompose the CO2, or CO2 could be used to react chemically with metal oxide minerals to for carbonate, which can then be safely stored or utilized.

In general, renewable energy production is a more energy-effective method (it has higher energy returned on energy invested ratio) than fossil fuels coupled with carbon capture and storage systems (Sgouridis, 2019). However, it might be necessary to deploy both to satisfy global energy consumption. Additional risks with carbon sequestration are related to leakage or accidental release of stored CO2.

Current carbon capture technology does not have a specific requirement for any critical minerals beyond general infrastructure requirements. However, new technologies that could be deployed in the future, like using metal-organic frameworks for physi- and chemisorption, will require critical minerals like zinc and nickel, putting further pressure on their price and demand.

Risk factors for the development of new green minerals mining projects

Geographical availability and concentration: some of these minerals are mostly concentrated in a small number of countries or one region. Much processing capacity is concentrated, mostly in China, which controls 35-90% of the world processing capacity for strategic green minerals, depending on the mineral in question.

China’s share of processing capacity: Copper, 40%; Nickel, 35%; Cobalt, 65%; Lithium, 58%; Rare Earths, 87%.

Long project development times: it takes around 15 years to proceed from deposit discovery to exploitation. For lithium, it is 4-7 years; for nickel, 13-19 years; for copper, it is 17 years. This raises a question about the ability of producers to quickly increase production to meet the increase in demand.

Resource depletion: ore quality naturally declines during exploitation, which increases production costs, reduces output, and increases energy costs. This makes the production of these minerals more expensive but also more carbon-intensive, increasing greenhouse gas emissions.

Environmental and social issues: mining projects tend to cause significant environmental damage, either locally or regionally. Poor management and labor relations also disrupt local communities, raising ethical questions about exploiting natural resources (Rÿser, 2022). On the other hand, customers are increasingly demanding sustainable and responsible exploitation. Climate risks: many mining and processing operations are water-intensive, exposing them to significant risks if their local water supply decreases or dries completely due to climate change. Over 50% of current lithium and copper production is located in regions with high levels of climate risk (extreme heat or droughts, flooding, etc.)

Strategic implications

Green energy minerals are found all over the world. However, many of them are found just in a few localities. Some countries have abundant minerals, while others contain large strategic reserves of just one or two. All of this has significant strategic implications. Countries with the greatest number of different green energy mineral deposits: Brazil 13, India 11, Kazakhstan 11, Namibia 11, South Africa 11, Mexico 10, Vietnam 10, Indonesia 9, Peru 8, Bolivia 7, Pakistan 7, Burma 6, Chile 6, Madagascar 6, Mongolia 6, Uzbekistan 6, Zimbabwe 6 (USAID, 2021).

Many of these countries are hostile to the US or Western countries, making them an unreliable source of strategic minerals. Therefore, it is worth examining which countries maintain solid relations with the US and Western countries. Countries that are among the top three producers of green energy minerals with USAID presence: Brazil (graphite, iron), Chile (copper, lithium, molybdenum), DR Congo (cobalt), Gabon (manganese), Guinea (aluminum), Indonesia (nickel), Kazakhstan (chromium), Mexico (silver), Mozambique (graphite), Peru (copper, silver, zinc), Philippines (nickel), South Africa (chromium, manganese, titanium) (USAID, 2021).

China has recently risen as the US and Western countries’ clear economic and geopolitical rival. In a scenario where strategic materials are in limited supply, it is to be expected that countries will compete for these resources and will be looking to secure them at the source. For the past decade, China has been investing in resource development internationally, mainly in Asia and Africa, creating strategic partnerships to secure the supply of strategic materials to the Chinese economy.

Major Chinese investments: DR Congo (cobalt), Ghana (manganese), Guinea (bauxite/aluminum), Congo (iron), Sierra Leone (iron), Burma (nickel, rare earth metals), Cuba (chromium), Indonesia (nickel), Afghanistan (copper, lithium)

Many resource-rich countries are found among undeveloped or developing countries. These countries are often controlled by corrupt governments or autocratic regimes or have been undergoing internal turmoil or civil war. Therefore, it is worth examining the levels of corruption and stability in countries that control large deposits of strategic green energy materials, giving us an idea of how reliable a partner these countries can be in trade and development.

Corruption perception index (rank out of 180): DR Congo (174), Mozambique (149), Guinea (137), Gabon (129), Mexico (124), Philippines (115), Indonesia (102), Brazil (94), Kazakhstan (94), Peru (94), South Africa (69), Chile (25) (IISD, 2018)

Fragile states rank (rank out of 179): DR Congo (5), Guinea (14), Mozambique (22), Philippines (49), Brazil (70), Peru (85), South Africa (89), Mexico (90), Indonesia (99), Gabon (101), Kazakhstan (116), Chile (144) (IISD, 2018)

Critical Green Energy Minerals

Cobalt

Cobalt is a metal that is one of the key components of batteries, which are currently used in electric vehicles. However, with a transition to renewable energy sources, larger vehicles, industrial energy storage, and home energy storage will also require batteries. Therefore, it is expected that demand for copper will increase by 400-600% by 2030, with its price increasing from around $60 to around $100 per kg ($27 to $45 per pound). This will significantly increase the supply risk and potentially open up a global supply gap of 20-30% (Rachidi, 2021).

Around 50% of global cobalt reserves (3.6 million tonnes) are located in the Democratic Republic of Congo (DR Congo), a highly unstable and corrupt country in central Africa (Deberdt, 2022). Other significant cobalt sources are found in Russia, Cuba, the Philippines, Madagascar, Papua New Guinea, South Africa, Zambia, Australia, Canada, and the United States. However, DR Congo accounts for around 71% of the global production, with the next largest producer, Russia, producing about 4%. This puts most of the world’s cobalt reserves and production in a highly unstable region, which has already seen significant Chinese economic investment and influence.

Chinese companies control around 70% of the cobalt mining sector in DR Congo, with total investments of around $6 billion. In addition, 15 out of 19 cobalt mines in DR Congo are under Chinese majority or minority ownership. Most recently, China Molybdenum announced it would invest $2.5 billion in the expansion of the Tenke Fungurume mine, where it owns an 80% stake.

Cobalt is one of the critical minerals where the strategic outlook for Western countries is extremely negative: more than 70% of reserves are located in fragile and corrupt countries, mostly in DR Congo. China controls around 65% of the world’s processing capacity. Although Australia (1.4 million t) and Canada (220,000 t) control significant reserves, China has been using infrastructure and the mining sector investment to secure cobalt production in Africa and Asia. This means that both the US and the EU will depend on Chinese cobalt production for a significant share of their cobalt consumption.

This would affect the automotive industry the most – EV batteries are currently produced with lithium cobalt oxide as cathode material, and all motor vehicles in the EU will have to be EVs beyond 2030. This will potentially allow China to outcompete the European automotive industry by securing less expensive resources for their automotive industry or by charging higher market prices for these resources to the rest of the world.

Cobalt reserves in fragile/corrupt countries: DR Congo (3.6 million t), Zambia (270,000 t), Madagaskar (150,000 t), Cuba (500,000 t), The Philippines (260,000 t), Russia (250,000 t) (IISD, 2018)

Rare Earths

Rare earths is a common moniker for a group of 17 elements that share similar electronic structure and, therefore, chemical properties and are typically found together. The most widely used of these are: dysprosium, neodymium, praseodymium, and gadolinium. Their unique electronic structure makes them a necessary component of magnets and magnetic materials used in wind turbines, energy storage devices, and some medical applications. Unfortunately, this also makes them hard to replace using more common metals because these are inherently less effective.

The global demand for these metals has already outstripped global supply, and it will keep increasing as renewable energy technologies are deployed to meet the Paris Agreement 2050 goals. The world’s largest supplier of rare earths is China, accounting for around 80% of the global supply and 36% of the known global reserves. However, these reserves in China are mostly located in Inner Mongolia (a poorly developed region in Northern China) and the southern province of Ganzhou. The mining operations have inflicted catastrophic environmental damage to these localities.

One area of improvement regarding rare earths supply is recycling. Historically, rare earths have had low, relatively insignificant rates of recycling. Therefore, there is much room for investment in this area, and the EU and the US governments have initiated programs to improve this and mitigate expected supply shortages as the demand increases and additional online capacities are insufficient to meet it.

Although rare earths consumption is relatively small, China’s dominance in rare earths production is a major strategic risk for Western countries. However, large rare earths reserves are located in Brazil and Vietnam, allowing this equation to be balanced by building sufficient processing capacities outside of China to provide for the world’s rare earths consumption. This would break China’s monopoly on this resource and provide a stable global supply independent of Chinese production. Therefore, Western countries must foster investment in this sector in Brazil and support a stable democratic regime.

Rare earths reserves in fragile/corrupt countries: China (44 million t), Brazil (22 million t), Vietnam (22 million t), Russia (18 million t), Malawi (140,000 t) (IISD, 2018)

Nickel

Nickel is a commonly used material in steel production, which consumes around 65% of the global demand. However, it is also a key component of nickel-metal-hydride (Ni-MH) rechargeable batteries, which already consume around 6% of its global demand, and many other green technologies. Consequently, the global demand for nickel is expected to increase by 30-80% over the next ten years and up to 1200% by 2050, putting significant pressure on its global supply and increasing the price. Its use in EV batteries is of particular importance, where all available technologies use nickel (nickel manganese cobalt and nickel cobalt aluminum), assuring high demand regardless of which technology becomes the dominant one.

Nickel reserves are much more common than other green minerals, with significant reserves in over 40 countries. However, 38% are found in fragile states, and 54% in countries with a high corruption index. Top nickel producers are Indonesia, the Philippines, Russia, and New Caledonia, which account for nearly 65% of the world’s production. Given the political instability in Indonesia and the Philippines, the current situation in Russia, and accounting for the contributions from China and Cuba, over 60% of the world’s nickel production is in regions with political instability or hostile to Western countries.

Given the expected sharp increase in demand, this is certain to put pressure on the price of nickel, demanding the development of new extraction projects, improved recycling efforts, and more efficient consumption. In addition, nickel production has suffered in recent years due to the environmental damage it causes in developing countries. For example, the Philippines’ government closed over two dozen mines and banned the opening of new ones amid evidence of gross environmental damage and land-use violations.

Strategically, nickel reserves are spread out. However, major reserves are controlled by relatively corrupt countries, indicating a need to make an effort to foster stability and anti-corruption measures in countries like the Philippines, Indonesia, Guatemala, and Brazil. This would provide a stable and consistent supply of nickel, which would benefit the automotive and energy production/storage industries. In addition, nickel is also widely used in other industries, like metallurgy, making it an economically very significant mineral and imperative for economic stability and prosperity to ensure a stable supply.

Nickel reserves in fragile/corrupt countries: Brazil (12 million t), Guatemala (1.8 million t), Philippines (4.8 million t), Indonesia (4.5 million t), Russia (7.6 million t), Cuba (5.5 million t), China (2.9 million t) (IISD, 2018)

Aluminum

Unlike most critical minerals for green technologies, aluminum is abundant, with global reserves estimated to be around 70 billion tonnes. In addition, it is relatively common, with significant deposits found in more than a dozen countries, including Australia, Brazil, and Jamaica, which practically guarantees relatively uninterrupted supply for the foreseeable future. However, aluminum extraction is an economically intense process with significant potential environmental damage attached, making it a challenge to quickly expand production capacities in case of a major global supply disruption.

The world’s largest producer of aluminum is China, which holds around 56% of the world’s processing capacity. The largest bauxite reserves, an aluminum ore, are found in Guinea (around 28% of total global reserves), a small, unstable, and corrupt country in West Africa with a GDP per capita of around $800, whose economy is dominated by agricultural and mining sectors. Aluminum ore and gold exports comprise over 90% of the total exports of Guinea, and the country has a history of military coups, most recently in 2021.

Aluminum production is dominated by joint ventures between the government of Guinea and foreign companies, including Alcoa, Rio Tinto Group, Dadco Investments, and Russian RUSAL. Aluminum Corporation of China Limited (Chinalco), a major shareholder in Rio Tinto Group, has developed cooperation with Rio Tinto Group on several projects, including the ones in Simandou, Guinea.

The relative abundance of aluminum globally means that Western countries can expect a relatively secure supply. However, the major cause of market disruption could come from the concentration of processing capacities in China, where a trade embargo would significantly disrupt the global aluminum supply chain, given China’s dominant position as a producer and its increasing investment in the exploitation of aluminum deposits globally.

Aluminum is a vital mineral for the broader economy, not just clean energy technologies. However, China controls more than half of the world’s processing capacity, which is a significant risk to the global aluminum supply. Therefore, it would be strategically beneficial for Western countries to increase domestic aluminum processing capacity, which would also be environmentally less damaging than traditional technologies used by China. This would provide stable global supply, prevent price fluctuations, and secure a vital strategic resource for Western economies.

Bauxite/alumina reserves in fragile/corrupt countries: Guinea (7.4 billion t), Vietnam (3.7 billion t), Jamaica (2 billion t), Indonesia (1 billion t) (IISD, 2018)

Lithium

Lithium is a key component of renewable energy storage solutions: for electric vehicles, mobile devices, tools, and home and industrial energy storage for renewable energy. Current lithium consumption for green energy applications represents around 30% of total lithium consumption. Therefore, it is estimated that the demand for lithium will increase rapidly over the next 20 years – by more than 40 times. However, the supply is not expected to meet this rapid increase in demand, and by 2030, it is expected that lithium production will only meet around half of the demand.

Lithium is exploited in two main forms: brine and spodumene. Brine deposits are located in arid areas in South America (Atacama) and northwestern China and produce lithium carbonate directly or process lithium carbonate to produce lithium hydroxide. The largest brine deposits are located in South America in the region nicknamed “The Lithium Triangle” in Argentina, Chile, and Bolivia, which contains close to 60% of global lithium reserves. Spodumene is a lithium aluminum silicate mineral, mostly found in Australia, Zimbabwe, and China, and the development of spodumene mines made Australia the world’s largest lithium producer. Lithium concentrates produced in Australia are mostly exported to China for further processing into lithium carbonate or lithium hydroxide.

Lithium production is expected to increase significantly in the short term, most likely doubling by 2025 due to the expansion of existing operations and new developments. However, the demand is expected to outpace this rapid supply increase, mainly due to the expected wide adoption of electric cars. In the long term, new technologies are expected to allow lithium extraction from sedimentary clay rocks (simpler and more energy-effective than extraction from spodumene) and waste rocks, expanding the scope of exploitable lithium deposits, while direct lithium extraction from brines is under development, which would significantly simplify lithium production. All these emerging technologies could contribute to a more rapid increase in lithium production while significantly reducing capital costs and environmental impact.

Recently, China has invested heavily into the development of lithium extraction in Zimbabwe: Suzhou TA&A Ultra Clean Technology Co. is investing over $35 million. Zhejiang Huayou Cobalt announced investment plans worth over $300 million after acquiring Arcadia hard-rock lithium mine outside Harare for $422 million. Sinomine Resource Group launched a mining project worth around $200 million after acquiring Bikita lithium mine for $180 million (as part of a global $450 million investment in lithium mining). Sinomine and Chengxin Lithium Group (which invested over $75 million in lithium and rare earths mineral blocks) also set up a joint venture for lithium projects in Zimbabwe.

Overall, Chinese acquisitions in Zimbabwe total over $700 million, with planned investments of another $500 million. Given that Zimbabwe has the fifth-largest lithium deposits in the world and the largest in Africa, this poses unique strategic challenges.

In addition, the Chinese Tianqi Lithium company acquired a 24% stake worth over $4 billion in Chilean company SQM, the world’s largest lithium producer, which controls mines in the South American Lithium Triangle. Furthermore, from 2012 to 2021, various Chinese companies invested another $2.5 billion in the acquisition of international lithium producers in Australia ($840 million), Canada ($24 million), Argentina ($1.1 billion), DR Congo ($240 million), and Mexico ($260 million). In 2021 alone, these investments were worth around $1.56 billion. Together with around $1.2 billion committed to Zimbabwe, this amounts to nearly $8 billion in international investments in the lithium sector.

Another area of concern is the environmental damage typically associated with lithium projects. Rio Tinto Group was forced to put its project for lithium extraction from jadarite in Serbia on hold due to persistent local protests. Chile, Bolivia, and Argentina have seen protests from the local indigenous communities regarding the development of lithium projects in Salar de Atacama, Salar de Uyuni, and the province of Jujuy, respectively.

Lithium projects are also very sensitive to climate stress – their operation requires large amounts of water, and there is a correlation between lithium operations and an increase in drought conditions in the region. Future development of lithium mining projects will have to be carefully balanced against the interests of local communities and the potential environmental damage.

Finally, lithium processing facilities are mostly concentrated in China: almost 60% of lithium products come from Chinese facilities, and China has been investing heavily in the lithium mining and processing sector. Over 80% of lithium hydroxide – used in EV batteries is produced in China, highlighting the need for diversification of lithium processing capabilities.

The strategic outlook for Western countries regarding lithium is relatively bad: although ample reserves are located in Chile, Argentina, and Australia, most of the lithium processing capacity is controlled by China. Combined with the fact that the same is true for cobalt, two key components of EV battery technology are under market domination by China, even though China does not necessarily control significant deposits of these resources. However, China has recognized the importance of these resources for economic development soon, especially for the automotive industry, invested billions in the mining sector, and built up domestic processing capacities while importing raw materials.

This provides the Chinese economy with significant resilience to market shock regarding lithium and cobalt, while the same is not true of Western economies, especially the EU.

Therefore, the main strategic goal for Western countries should be to build up domestic processing capacities that can provide stable supply to their economies. This would protect them from potential Chinese market manipulation and provide more price stability in the face of the rapidly rising demand.

Lithium reserves in fragile/corrupt countries: China (3.2 million t), Zimbabwe (23,000 t), Brazil (48,000 t) (IISD, 2018)

Copper

Copper is widely used as a thermal and electrical conductor in electrical grids, installations, and many other electronic and industrial applications. Therefore, it has been one of the modern age’s key elements, and considerable production capacities are already in existence. This ubiquitous character of copper makes it near impossible to replace as technological material.

However, the long exploitation of copper deposits has led to their depletion over the decades of usage. Copper producers’ main problem is ramping up production to meet the increasing demand. Over the past 20 years, the copper ore grade in Chile has declined by around 35%, which corresponds to around 40% higher energy use for the extraction of one tonne of copper. The decline in ore quality will eventually lead to declining production in major mines around the world – in Escondida in Chile, the world’s largest copper mine, the production has already reached its peak and has started to decline at a rate of around 1% per year.

Rising energy costs and increasing energy demands of copper production also put pressure on the production price of copper since energy costs already account for around 19% of the total mining cost and around 28% of the total processing cost.

It is estimated that copper production will decline around 10% over the next ten years despite a 25% increase in global demand. However, the total known reserves of copper have been increasing as new deposits have been discovered. In the past 10 years, they have increased from around 700 to around 850 million tonnes, while annual production has stagnated at around 20 million. Even after copper production increases, it is estimated to fail to keep pace with the increasing demand.

In addition, copper production faces severe environmental challenges: major copper-producing areas in South America are experiencing extremely high climate change risks due to water scarcity. The decline in ore quality also means more toxic impurities that must be captured or filtered out to prevent their release into the environment. All of this puts upward pressure on production costs and the production price of copper.

It is estimated that copper production will decline around 10% over the next ten years despite a 25% increase in global demand, although the total known reserves of copper have been increasing as new deposits have been discovered. In the past 10 years, they have increased from around 700 to around 850 million tonnes, while annual production has stagnated at around 20 million tonnes. Even after copper production begins to increase, it is estimated to fail to keep pace with the increasing demand.

More than half of the global copper production is concentrated in four countries: Chile, Peru, China, and DR Congo. China also controls a major share of world processing capacity – around 40%, followed by Chile, Japan, and Russia. China is expected to account for around half of all processing capacity additions in the near future, solidifying its position as the world leader in copper processing. This also gives China more power in the world market, allowing it to exercise more influence and potentially manipulate the prices. Given the instability and high Chinese influence in DR Congo, any trade conflict with China would probably affect around 50% of the world’s copper production.

Based on all of this, it is necessary to develop new copper production projects to counter the expected decline in production output of current operations and to meet the expected increase in demand due to the broad adoption of green technologies and renewable energy. Part of this will have to be achieved through improved recycling and conservation, while we will also have to rely on new technologies to reduce the copper usage of current technologies. In addition, modern technologies like aerial and satellite surveys, computer models, and geographic information systems allow more effective discovery of copper deposits, allowing greater possibilities to ramp up production and develop the most cost-effective deposits available.

Copper is a foundational mineral for every economy – the entire electric grid infrastructure is built out of copper. Therefore, stable supply and resilience against market shock is a necessity for Western economies in a situation where China controls around 40% of the world’s processing capacity. Similar to other minerals, expansion of domestic processing capacity is a vital measure to secure sustainable long-term economic development and implementation of climate change mitigation strategy. Copper reserves in fragile/corrupted countries: DR Congo (20 million t), Zambia (20 million t), China (27 million t), Indonesia (26 million t) (IISD, 2018)

Graphite

Graphite is a novel conductor material that has been one of the hallmarks of 21st-century technology. It is an allotrope of carbon, an excellent conductor of heat and electricity, and extremely high strength. It is most widely used in lithium-ion batteries. It is expected that the demand for graphite could increase 5 to 7 times over the next decade due to a surge in the use of electric vehicles and the corresponding need for rechargeable batteries.

The world’s largest graphite producer is China, with over 800,000 tonnes, followed by Brazil (~70,000 t), Mozambique (~30,000 t), Russia (27,000 t), Ukraine (17,000 t), Norway (13,000 t), and Canada (~9,000 t). This shows that China currently accounts for nearly 80% of the world’s production, while much of the remaining capacity is located in countries with low stability and local conflicts (Mozambique, Russia, and Ukraine).

Given the importance of graphite in green energy storage technologies, especially in EV batteries, this creates a large strategic risk for Western countries, which are essentially dependent on the Chinese supply of graphite. Since countries like Turkey and Brazil control significant graphite reserves, which have not been fully developed, Western countries should be looking to these regions to secure alternative sources of graphite. This would provide market stability, additional production capacities in the face of increasing demand (due to increased production of electric vehicles), and protect against potential market manipulation by China.

In addition, this would provide the necessary resource for the automotive industry and a vital component of a climate change mitigation strategy. Graphite reserves in fragile/corrupt countries: Turkey (90 million t), Brazil (70 million t), China (55 million t), Tanzania (17 million t), Mozambique (17 million t), Madagascar (1.6 million t) (IISD, 2018)

Zinc

Zinc is a material that is already widely used in industry, and its application in green technology is mostly in batteries and wind and solar power generation. This relatively wide use makes it key to the expansion of the use of green technologies and climate change mitigation.

Its annual production is around 13 million tonnes, with China being the largest producer with around 4.5 million tonnes. However, it is relatively widely available, with 25% of the global production coming from Australia, the United States, Mexico, Canada, and Sweden. Another 10% of global output is produced by Peru, making zinc one of the materials with low strategic risk when it comes to country instability or armed or trade conflicts. Even though the US has significant domestic production, around 76% of its zinc consumption comes from imports – mostly from Mexico, Canada, and Peru, highlighting the overall strategic importance of zinc to the US and the world economy.

However, a relatively high percentage of zinc production is exposed to medium to high levels of climate risk, especially high water stress. Only around 43% of global zinc production is estimated to come from areas with low climate risk. On the other hand, around 25% come from areas with an extremely high risk of water stress (drought or flooding), and another 16% come from areas with high risk. Therefore, developing new production capacities needs to focus on areas with lower climate risks. This highlights the need to mitigate climate change because the advance of climate change could diminish humanity’s capacity to combat its effects by denying us the resources to do so.

Conclusion

Green technologies are poised to expand significantly over the next 30 years as the effort to mitigate climate change effects in accordance with the Paris Agreement ramps up. Consequently, the demand for materials required for these technologies will increase significantly over the same period. The main focus of any strategic discussion is a group of minerals that are both critical to the current and future economy and in short supply domestically. These minerals are called critical minerals. Out of these minerals, as they apply to green technologies, a particular subgroup is found predominantly in countries and regions with unstable or autocratic regimes – green conflict minerals.

Therefore, the supply of these minerals is determined predominantly by the local and regional political situation and stability. The other important aspect of mineral supply is the environmental impact of mining and processing operations, ensuring that these critical minerals are obtained sustainably.

Only 42% of copper, 22% of lithium, 19% of nickel, and 9% of cobalt worldwide have been produced in countries with stable governments and low emissions intensity (IEA, 2022). The majority of the world’s production of green technology minerals comes from countries and regions with relatively unstable governments or high emissions intensity, or both, raising questions about the sustainability of this production and its ability to contribute to climate change mitigation. Regrettably, this includes countries like Australia (the world’s largest lithium producer) and Canada (a major nickel producer), where the mining industry has a bad environmental record.

The mineral processing chain contains both the extraction/deposit and mineral processing facilities. Because of the de-industrialization process of the 1990s, where Western countries moved significant industrial capacities overseas, China is the dominant country in the global mineral processing capacity, holding from 40-80% of the global processing capacity, depending on the mineral. This means that even if Western countries secure their global critical minerals supply chains, they would still rely on Chinese processing capacities for most of these minerals.

Therefore, the outlook regarding critical minerals for green technology is relatively bleak: much of these minerals are essentially conflict minerals, coming from countries with low stability or authoritarian regimes (including China). Most of the global mineral processing capacity is located in China, and China has been moving to secure mineral deposits in developing countries through billions in investments (Wenchang, 2022). In the event of a trade war, cooling of economic relations between China and the West, or simply increased competition for limited mineral resources, Western countries could find that the availability of these critical minerals limits their efforts to mitigate climate change.

This could not only impact the efforts to mitigate climate change but also stunt economic growth, increase consumer prices and diminish the quality of life for large sections of the population in Western countries.

The solution is to refocus Western investments into countries that can provide the necessary mineral resources coupled with a socio-economic investment that would stabilize these countries, reduce corruption, and improve the general quality of life. This effort has already started under the banner of “responsible sourcing” (Zhang, 2019; Debert, 2021). In addition, expanding the processing capabilities is required to provide domestic processing facilities and account for the expected increase in production. Therefore, the focus of Western markets should be to preferentially accept domestically or regionally processed resources, both on account of the strategic stability of the supply chain and the reduced carbon footprint of the transport of these goods.

This would increase the cost of these materials but provide stable and less carbon-intensive production, which is a necessary part of a zero-carbon economy strategy.

The final component of a sustainable system is increased recycling, bolstered by technological advances that would reduce the application requirements for critical minerals (Kirschner, 2022). Currently, only around 3% of critical minerals are recycled, so there is much room for improvement.

References

Church, C. and Crawford, A., 2020. Minerals and the metals for the energy transition: Exploring the conflict implications for mineral-rich, fragile states. In The Geopolitics of the Global Energy Transition (pp. 279-304). Springer, Cham.

Deberdt, R. and Le Billon, P., 2021. Conflict minerals and battery materials supply chains: A mapping review of responsible sourcing initiatives. The Extractive Industries and Society, 8(4), p.100935.

Deberdt, R. and Le Billon, P., 2022. The Green Transition in Context—Cobalt Responsible Sourcing for Battery Manufacturing. Society & Natural Resources, pp.1-20.

IEA, 2022, The Role of Critical Minerals in Clean Energy Transitions: World Energy Outlook Special Report, Available at: https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions

IISD, 2018, Green Conflict Minerals, The fuels of conflict in the transition to a low-carbon economy, Available at: https://www.iisd.org/story/green-conflict-minerals/

Kirschner, M., 2022. Why the circular economy will drive green and sustainable chemistry in electronics. Advanced Sustainable Systems, 6(2), p.2100046.

Rachidi, N.R., Nwaila, G.T., Zhang, S.E., Bourdeau, J.E. and Ghorbani, Y., 2021. Assessing cobalt supply sustainability through production forecasting and implications for green energy policies. Resources Policy, 74, p.102423.

Rÿser, R.C., 2022. Green energy mining and Indigenous peoples’ troubles: Negotiating the shift from the carbon economy to green energy with FPIC. Fourth World Journal, 22(1), pp.101-120.

Sgouridis, Sgouris; Carbajales-Dale, Michael; Csala, Denes; Chiesa, Matteo; Bardi, Ugo (June 2019). “Comparative net energy analysis of renewable electricity and carbon capture and storage” (PDF). Nature Energy. 4 (6): 456–465.

UNFCCC, 2018, The Paris agreement. United Nations Climate Change, 20 April 2018. https://unfccc.int/process-and-meetings/the-paris-agreement/the-paris-agreement

USGS, 2022, US Department of the Interior, US Geological Survey, Mineral Commodity Summaries 2022, Available at: https://pubs.er.usgs.gov/publication/mcs2022

USAID, 2021, Mining And The Green Energy Transition: Review Of International Development Challenges And Opportunities, Available at: https://land-links.org/document/mining-and-the-green-energy-transition-review-of-international-development-challenges-and-opportunities/

Wenchang, L.I., Jianwei, L.I., Guiqing, X.I.E., Xiangfei, ZHANG, and Hong, L.I.U., 2022. Critical minerals in China: Current status, research focus, and resource strategic analysis. Earth Science Frontiers, 29(1), p.1.

Zhang, H., Aydin, G. and Heese, H.S., 2019. Curbing the usage of conflict minerals: A supply network perspective. Decision Sciences.

Appendix

US Net Import Reliance:

ARSENIC, all forms, 100%, %, China, Morocco, Belgium

ASBESTOS, 100%, Brazil, Russia

CESIUM, 100%, Germany, China

FLUORSPAR, 100%, Mexico, Vietnam, South Africa, Canada

GALLIUM, 100%, China, United Kingdom, Germany, Ukraine

GRAPHITE (NATURAL), 100%, China, Mexico, Canada, India

INDIUM, 100%, China, Canada, Republic of Korea, France

MANGANESE, 100%, Gabon, South Africa, Australia, Georgia

MICA (NATURAL), sheet, 100%, China, Brazil, Belgium, India

NEPHELINE SYENITE, 100%, Canada

NIOBIUM (COLUMBIUM), 100%, Brazil, Canada

RUBIDIUM, 100%, Germany

SCANDIUM, 100%, Europe, China, Japan, Russia

STRONTIUM, 100%, Mexico, Germany, China

TANTALUM, 100%, China, Germany, Australia, Indonesia

VANADIUM, 100%, Canada, China, Brazil, South Africa

YTTRIUM, 100%, China, Republic of Korea, Japan

GEMSTONES, 99%, India, Israel, Belgium, South Africa

TELLURIUM, >95%, Canada, Germany, China, Philippines

POTASH, 93%, Canada, Russia, Belarus

IRON OXIDE PIGMENTS, natural and synthetic, 91%, China, Germany, Brazil

RARE EARTHS, compounds, and metals, >90%, China, Estonia, Malaysia, Japan

TITANIUM, sponge, >90%, Japan, Kazakhstan, Ukraine

BISMUTH, 90%, China, Republic of Korea, Mexico, Belgium

TITANIUM MINERAL CONCENTRATES, 90%, South Africa, Australia, Madagascar, Mozambique

ANTIMONY, metal, and oxide, 84%, China, Belgium, India

STONE (DIMENSION), 84%, China, Brazil, Italy, India

CHROMIUM, 80%, South Africa, Kazakhstan, Russia, Mexico

PEAT, 80%, Canada

SILVER, 79%, Mexico, Canada, Chile, Poland

TIN, refined, 78%, Indonesia, Peru, Malaysia, Bolivia

COBALT, 76%, Norway, Canada, Japan, Finland

DIAMOND (INDUSTRIAL), stones, 76%, South Africa, India, Congo (Kinshasa), Botswana

ZINC, refined, 76%, Canada, Mexico, Peru, Spain

ABRASIVES, crude fused aluminum oxide, >75%, China, France, Bahrain, Russia

BARITE, >75%, China, India, Morocco, Mexico

BAUXITE, >75%, Jamaica, Brazil, Guyana, Australia

SELENIUM, >75%, Philippines, China, Mexico, Germany

RHENIUM, 72%, Chile, Canada, Kazakhstan, Japan

PLATINUM, 70%, South Africa, Germany, Switzerland, Italy

ALUMINA, 58%, Brazil, Australia, Jamaica, Canada

GARNET (INDUSTRIAL), 56%, South Africa, China, India, Australia

MAGNESIUM COMPOUNDS, 55%, China, Brazil, Israel, Canada

ABRASIVES, crude silicon carbide, >50%, China, Netherlands, South Africa

GERMANIUM, >50%, China, Belgium, Germany, Russia

IODINE, >50%, Chile, Japan

TUNGSTEN, >50%, China, Bolivia, Germany, Canada

CADMIUM, <50%, Australia, China, Germany, Peru

MAGNESIUM METAL, <50%, Canada, Israel, Mexico

NICKEL, 48%, Canada, Norway, Finland, Australia

COPPER, refined, 45%, Chile, Canada, Mexico

ALUMINUM, 44%, Canada, United Arab Emirates, Russia, China

DIAMOND (INDUSTRIAL), bort, grit, dust, and powder, 41%, China, Ireland, Republic of Korea, Russia

LEAD, refined, 38%, Canada, Mexico, Republic of Korea, India

PALLADIUM, 37%, Russia, South Africa, Germany

FELDSPAR, 32%, Turkey

SILICON, metal and ferrosilicon, 32%, Russia, Brazil, Canada, Norway

SALT, 29%, Chile, Canada, Mexico, Egypt

MICA (NATURAL), scrap and flake, 28%, Canada, China, India

LITHIUM, >25%, Argentina, Chile, China, Russia

BROMINE, <25%, Israel, Jordan, China

ZIRCONIUM, ores and concentrates, <25%, South Africa, Senegal, Australia, Russia

PERLITE, 23%, Greece, China, Mexico, Turkey

VERMICULITE, 20%, South Africa, Brazil

Mineral, US Consumption (metric tons); US share of imports; main import partner; World leading producing country, percentage of world production produced by the world leader

Aluminum (bauxite), 3,600,000; >75%, Jamaica; Australia, 28%

Antimony, 28,000; 84%, China; China, 55%

Arsenic, 6,800; 100%, China; Peru, 46%

Barite, >75%, China; China, 38%

Beryllium, 200; 16%, Kazakhstan; the United States, 65%

Bismuth, 810; 90%, China; China, 84%

Chromium, 590,000; 80%, South Africa; South Africa, 44%

Cobalt, 6,700; 76%, Norway; Congo (Kinshasa), 71%

Fluorspar, 100%, Mexico; China, 63%

Gallium, 100%, China; China, 98%

Germanium, 530; >50%, China; China, 68%

Graphite (natural) 45,000; 100%, China; China, 82%

Helium, 40; Export, Qatar; the United States, 44%

Indium, 170; 100%, China; China, 58%

Lithium, 52,000; >25%, Argentina; Australia, 55%

Magnesium, 50,000; <50%, Canada; China, 84%

Manganese, 640,000; 100%, Gabon; South Africa, 37%

Niobium, 7,000; 100%, Brazil; Brazil, 88%

Palladium (platinum-group metal), 90; 37%, Russia; South Africa, 40%

Platinum (platinum-group metal), 37; 70%, South Africa; South Africa, 72%

Potash, 7,400,000; 93%, Canada; Canada, 30%

Rare-earth elements, 6,100; >90%, China; China, 60%

Rhenium, 32; 72%, Chile; Chile, 49%

Scandium; 100%; China

Strontium, 4,800; 100%, Mexico; Spain, 42%

Tantalum, 710; 100%, China; Congo (Kinshasa), 33%

Tellurium; >95%, Canada; China, 59%

Tin 45,000; 78%, Indonesia; China, 30%

Titanium; >90%, Japan; China, 57%

Tungsten; 50%, China; China, 84%

Vanadium; 3,600; 100%, Canada; China, 66%

Zirconium, 30,000; <25%, South Africa; Australia, 36%

Glossary of Terms:

- Green Energy Minerals: Minerals essential for the production and development of renewable energy technologies, including solar panels, wind turbines, and batteries. These minerals are pivotal in transitioning to a sustainable energy future.

- Zero-Carbon Economy: An economic system where all energy production and consumption processes generate no net carbon dioxide emissions, aiming to mitigate climate change by utilizing renewable energy sources and carbon capture technologies.

- Clean Energy Technologies: Innovations and systems designed to generate energy from renewable, zero-emission sources, significantly reducing pollutants and greenhouse gas emissions compared to conventional fossil fuels.

- Strategic Implications of Green Minerals: The geopolitical and economic consequences stemming from the distribution, accessibility, and control over minerals critical for renewable energy technologies, impacting national security and international relations.

- Renewable Energy Resources: Natural sources of energy that are replenished on a human timescale, such as sunlight, wind, rain, tides, and geothermal heat, used to produce electricity with minimal environmental impact.

- Critical Minerals for Clean Energy: Minerals deemed essential for the development and maintenance of renewable energy technologies and systems, whose supply constraints pose a risk to clean energy transition.

- Cobalt and Lithium Demand: The increasing need for cobalt and lithium, primarily driven by their crucial roles in manufacturing rechargeable batteries for electric vehicles and portable electronics.

- Rare Earths in Renewable Energy: Elements essential for the production of high-performance magnets, batteries, and other components critical to wind turbines, electric vehicles, and other renewable energy technologies.

- Energy Storage Solutions: Technologies and methods for storing energy produced at one time for use at a later time, crucial for balancing supply and demand in electricity grids powered by intermittent renewable energy sources.

- Environmental Impact of Mineral Mining: The ecological consequences of extracting minerals, including habitat destruction, water pollution, and greenhouse gas emissions, necessitating sustainable mining practices.

- Climate Change Mitigation Strategies: Actions and policies aimed at reducing greenhouse gas emissions and enhancing carbon sinks to slow or reverse the effects of climate change.

- Sustainable Mining Practices: Methods of mineral extraction that minimize environmental degradation and ensure the well-being of local communities, while also considering the long-term availability of mineral resources.

- Electric Vehicle Battery Minerals: Minerals such as lithium, cobalt, nickel, and manganese, essential for the manufacture of batteries that power electric vehicles, playing a critical role in reducing emissions from the transportation sector.

- Global Mineral Supply Chain: The international network involved in the production, processing, and distribution of minerals, critical for the manufacturing of clean energy technologies and devices.

- Mineral Recycling and Conservation: Practices aimed at reducing the demand for virgin minerals through the recovery and reuse of materials from end-of-life products and promoting efficient use of resources.

Q & A with Author

What are green energy minerals?

Green energy minerals, also known as critical minerals, are elemental components vital for the production and functionality of renewable energy technologies. These minerals include, but are not limited to, lithium, cobalt, rare earth elements (REEs), nickel, and copper. They are essential for the fabrication of photovoltaic cells, wind turbines, electric vehicle batteries, and other technologies pivotal to the transition towards a sustainable, low-carbon future.

How do minerals impact the zero-carbon economy?

Minerals are the bedrock upon which the zero-carbon economy is constructed. Their extraction, refinement, and implementation into clean energy technologies directly influence the scalability, efficiency, and viability of renewable energy sources. By enabling the mass production of zero-emission technologies, these minerals significantly reduce greenhouse gas emissions, thereby impacting the global endeavor to mitigate climate change and achieve carbon neutrality.

Which clean energy technologies require critical minerals?

Virtually all clean energy technologies necessitate critical minerals for their production and operation. Photovoltaic solar panels require silicon, along with silver and tellurium; wind turbines utilize neodymium and dysprosium for their magnets, as well as steel, aluminum, and copper; electric vehicles and grid storage solutions are dependent on lithium, cobalt, nickel, and graphite for their batteries.

What are the strategic implications of relying on certain minerals for renewable energy?

The strategic implications are multifaceted, encompassing geopolitical, economic, and environmental dimensions. Dependence on specific minerals for renewable energy technologies introduces vulnerability to supply chain disruptions, geopolitical tensions, and market volatility. It also raises concerns about the concentration of mineral resources and processing capabilities in a few countries, potentially leading to unequal power dynamics and the need for diversification and secure supply chains.

How is the demand for cobalt and lithium changing?

The demand for cobalt and lithium is experiencing unprecedented growth, primarily driven by the surge in electric vehicle (EV) production and the global push for energy storage solutions. This demand is projected to increase exponentially as the world accelerates its transition to renewable energy sources and seeks to electrify transportation to reduce carbon emissions.

Why are rare earths important for renewable energy technologies?

Rare earth elements are crucial due to their unique magnetic, luminescent, and electrochemical properties. They are integral in manufacturing powerful magnets for wind turbines and electric motors in EVs, enhancing efficiency and performance. Their importance cannot be overstated, as they enable significant advancements in renewable energy technology and contribute to energy efficiency and the miniaturization of electronic components.

What solutions exist for energy storage in a zero-carbon economy?

Energy storage solutions critical to a zero-carbon economy include lithium-ion batteries, redox flow batteries, solid-state batteries, and hydrogen storage. These technologies facilitate the storage of surplus renewable energy for later use, ensuring a stable and reliable energy supply even when renewable sources are intermittent. Advancements in these technologies are paramount for balancing energy grids and enabling the widespread adoption of renewable energy.

What are the environmental impacts of mining for green energy minerals?

Mining for green energy minerals can have significant environmental impacts, including habitat destruction, water pollution, and greenhouse gas emissions. The extraction processes, if not managed sustainably, can lead to biodiversity loss, soil erosion, and contamination of water bodies, undermining the ecological benefits of transitioning to a renewable energy economy.

How can we mitigate climate change through sustainable mineral practices?

Mitigating climate change through sustainable mineral practices involves minimizing the environmental footprint of mining operations, promoting the circular economy through recycling and reuse of minerals, and developing alternative materials with lower environmental impacts. Implementing strict environmental regulations, investing in cleaner extraction technologies, and enhancing global cooperation on sustainable mineral management are essential strategies.

How does the global supply chain affect mineral availability for clean energy?

The global supply chain significantly affects mineral availability through its complexity, vulnerability to geopolitical tensions, and susceptibility to disruptions from natural disasters, labor disputes, and regulatory changes. Concentration of mineral production and processing in a few countries also poses risks of supply shortages, price volatility, and access issues, emphasizing the need for diversified supply sources and strategic reserves.

What are the challenges and opportunities in mineral recycling for green technologies?

The primary challenges in mineral recycling include technological limitations, economic viability, collection and sorting logistics, and quality degradation of recycled materials. However, opportunities abound in developing more efficient recycling technologies, expanding recycling infrastructure, and integrating recycling into the design phase of products. Recycling presents a pathway to reduce dependence on virgin mineral resources, decrease environmental impacts, and foster a more sustainable and resilient supply chain for green technologies.