“What’s the use of a fine house if you haven’t got a tolerable planet to put it on.”

— Henry David Thoreau

Introduction

Carbon Neutral Strategies — Our planet has evolved to heal itself through the natural process of photosynthesis and carbon sequestration. But Earth’s natural mechanisms for self-healing are no match for man’s hyper-toxic industrial emissions that accelerate anthropogenic climate change. The Paris Climate Agreement and the recent COP26 Climate Conference have set ambitious goals for the reduction of anthropogenic greenhouse gas (GHG) emissions with the goal of reaching net-zero emissions by 2050 and limiting the global increase in temperatures to 1.5oC. To reach these goals, immediate and coordinated action is required. While new technologies are being developed to help reach these goals using renewable energy, carbon sequestration from the atmosphere, etc., there are technologies and solutions that can be deployed immediately to reduce GHG emissions. The most effective solutions are market-based solutions that can be implemented without a large permanent public investment. However, these solutions will probably need public-private partnerships to accelerate their adoption to meet the GHG emissions reduction goals.

It has been well-established that climate change is primarily driven by anthropogenic greenhouse gas emissions – human activity is causing long-term detrimental climate trends that are very difficult or impossible to reverse. Therefore, for the past few decades, there has been a concerted international effort to reduce global greenhouse gas emissions. However, these efforts have been largely ineffective. The concentration of atmospheric CO2 reached 414.7 ppm at the end of 2021, even though the reduction of CO2 emission in 2020 slowed down the rate of increase of the atmospheric CO2 concentration by about 0.18 ppm (Global Carbon Budget, 2021). The atmospheric CO2 growth amounted to around 47% of total CO2 emissions during the last decade with the rest absorbed by CO2 sinks (land absorbs around 28% and ocean around 25% of total emissions).

After a decrease of around 5.4% in global greenhouse gas emissions in 2020, induced by lockdowns and interruptions in global trade and travel caused by the COVID-19 pandemic, the emissions bounced back in 2021 to values close to pre-pandemic levels (Global Carbon Budget, 2021). The decrease in 2020 was 1.9 GtCO2/yr, for around 34.8 GtCO2/yr, comparable to the 2012 emissions level; however, the total emissions in 2021 were around 36.4 GtCO2/yr, compared to 36.7 GtCO2/yr in 2019. This can be attributed mostly to the increased demand for energy, with emissions from coal and gas increasing above 2019 levels (mainly caused by electricity production), while emissions from oil remained below the 2019 level due to lower demand for global transport and travel.

On the national level, the increase is driven by developing countries: emissions in China were higher by 5.5% compared to 2019 levels, reaching 11.1 GtCO2/yr; India exhibited 4.4% higher emissions, reaching 2.7 GtCO2/yr (Global Carbon Budget, 2021). But the 2021 emissions in the United States (5.1 GtCO2/yr), the European Union (2.8 GtCO2/yr), and the rest of the world (14.8 GtCO2/yr ) remain at 3.7%, 4.2%, and 4.2% lower than respective 2019 levels.

The carbon budget is an estimated total amount of global emissions with a 50% likelihood to limit global warming to a particular level – levels usually considered are 1.5°C, 1.7°C, and 2°C increase in average global temperatures. At the start of 2022, the estimated remaining carbon budget has shrunk to 420, 770, and 1270 GtCO2, for a global temperature increase of 1.5°C, 1.7°C, and 2°C, respectively (Global Carbon Budget, 2021). This is equivalent to 11, 20, and 32 years of emissions at the 2021 level, respectively. Total anthropogenic emissions were 38.0 GtCO2/yr in 2020 and 39.4 GtCO2/yr in 2021. To reach net zero emissions by 2050, we must cut about 1.4 GtCO2 per year on average, which is the difference between 2020 and 2021 emissions. This highlights the magnitude of the task at hand and the urgency of immediate action.

There is a complementary market mechanism that can accelerate the adoption of methods for the reduction of GHG emissions – carbon markets. This is a market framework where carbon savings and negative emissions can be traded by entities that employ carbon sequestration methods to allow other companies to compensate for their emissions while providing a financial stimulus for carbon sequestration and GHG emissions reduction. This also drives innovation because the development of better GHG emissions reduction methods can bring immediate economic benefits. These carbon markets have been shown to provide an effective market-based mechanism for emissions reduction, and the main issue has been to expand them geographically, increase the supply of carbon credits, and provide a uniform framework for their operation.

Under the Kyoto Protocol, 192 countries committed to the reduction of greenhouse emissions. Signed in 1997, the Protocol came into force in 2005, although Canada withdrew in 2012, and the United States never ratified it. During the first commitment period (2008-2012), 36 countries participated to reduce their greenhouse gas emissions with mixed success, while 37 countries (34 ratified) entered the second commitment period (2012-2020) with additional targets.

In 2015, the Paris Agreement was agreed upon by 196 countries to keep the overall global temperature change below 2°C and preferably to 1.5°C. The emissions are to be reduced quickly, and net-zero emissions should be achieved by 2050. However, the current national targets set under the Paris Agreement would be insufficient to reach these stated goals, while enforcement mechanisms are weak or non-existent.

Achieving Carbon Emissions Goals by 2030/2050 | Carbon Neutral Strategies

Most research and development efforts in carbon capture focused on efficiency improvements of the CO2 separation process, which is the most complex and costly component. These technologies are generally called carbon capture utilization and storage technologies. Capture processes are grouped based on the stage of carbon use where they are deployed. The suitability of a particular CCUS technology to a particular industrial process depends on the process or the power plant.

Post-combustion: CO2 is removed from the flue gas resulting from the combustion of fossil fuel. Post-combustion separation involves the use of a solvent to capture the CO2. Common applications: pulverized coal (PC) plants and natural gas combined cycle plants (NGCC). This technology is most commonly used and can be retrofitted to existing applications (Parliamentary Office of Science & Technology, 2009).

Pre-combustion: The primary fuel in the process is converted to a mix of carbon monoxide and hydrogen (syngas) through a reaction with steam and air. The carbon monoxide is converted to CO2 in a ‘shift reactor’. The CO2 can then be separated, and the hydrogen is used to generate power and/or heat. Common application includes integrated gasification combined cycle (IGCC) power plants (IPCC, 2005).

Oxy-fuel combustion: The primary fuel is combusted in oxygen instead of air to produce a flue gas containing mainly water vapor and a high concentration of CO2 (80%). The flue gas is then cooled to condense the water vapor, which leaves an almost pure stream of CO2. Additional equipment is required for the in situ production of oxygen from the air (Mckinsey & Company, 2008).

Industrial processes: The separation technologies can also be used in various industries, such as natural gas processing and steel, cement, and ammonia production (IPCC, 2005). Carbon capture and storage (CCS) could capture between 85 and 95% of all CO2 produced (IPCC, 2005), but net emission reductions are in the order of 72 to 90% due to the energy it costs to separate the CO2 and the upstream emissions (Viebahn et al., 2007). Once CO2 has been effectively ‘captured’ from a process, it must be transported to a suitable storage location. CO2 is most efficiently transported when compressed to a pressure above 7.4 MPa and a temperature above approximately 31˚C. Suitable CO2 storage locations include abandoned oil and gas fields or deep saline formations, with an expected minimum depth of 800 m, where the ambient temperature and pressures are sufficiently high to keep the CO2 in a liquid or supercritical state. The CO2 is prevented from migrating from the storage reservoir through physical and geophysical trapping mechanisms (IPCC, 2005). The technologies used to inject CO2 are similar to those used in the oil and gas industry.

Applying technologies elsewhere suggests CCS is technically feasible in most large, stationary CO2 point sources. Natural gas processing (NGP) removes CO2 from natural gas to improve its heating value or meet pipeline specifications. CO2 storage, combined with NGP, has been successfully demonstrated at the Sleipner gas field in Norway and in the In Salah gas fields in Algeria. There are several planned CCS plants globally:

- the Quest CCS Project in Alberta, Canada (1.2 MtCO2 per annum); operational since late 2015

- the Kemper County IGCC Project, in Mississippi (600 MW integrated gasification combined cycle power station, 3.5 MtCO2 per annum)

The Global CCS Institute identified 12 CCS projects in operation with 8 projects undergoing construction (Global CCS Institute, 2013).

Carbon capture and storage (CCS) has the potential to reduce CO2 emissions significantly from power generation and industrial installations. The greatest risk associated with CCS is possible leakage from pipeline systems and storage sites. While the risks of CO2 leaking from a pipeline do not differ from the transportation of natural gas, CO2 is not flammable, so the risk of major environmental damage is significantly lower. However, any leakage of CO2 would reverse the effects of the CCS process by releasing CO2 into the atmosphere, making it an important operational issue. Regulatory frameworks and standards for the transport and permanent storage of CO2 are common in many countries, ensuring CCS projects do not threaten humans or the environment.

Additional negative environmental impacts of CCS include increased fossil fuel or energy consumption, due to the energy needed for the process, and the potential environmental impact of the solvents used to chemically trap the CO2 (Zapp, 2012). Therefore, there is a trade-off between the GHG emissions abatement and the environmental impacts of reduced energy efficiency and potential environmental damage.

Most applications of CCS are not economically feasible. The additional equipment used to capture and compress CO2 also require significant energy, which increases the fuel needs of a coal-fired power plant by between 25 and 40% and drives up the costs (IPCC, 2005). CCS demonstration projects in the power sector are expected to cost $90-130/tCO2 avoided, with the cost possibly dropping to $50-75/tCO2 for full-scale commercial activities taking place after 2020 (Mckinsey & Company, 2008). These costs consider the energy penalty of CO2 capture but not the upstream emissions, so they assume an emission reduction of 80 to 90% compared to a conventional plant.

Recently, focus has been on assessing the potential and costs of CCS in the industrial sector (UNIDO/IEA, 2011; ZEP, 2013). Many industrial processes, for example, primary steel production, cement production, and oil refining, are operating at the limits of energy efficiency, and CO2 capture is the only technology able to reduce emissions further. The United States offers companies a tax credit of $50 for each ton of CO2 they capture and store underground. And recently, a bill that provides $3.5 billion for carbon capture projects passed in Congress.

|

|

|

Environmental Commodities

Environmental commodities are a class of financial products represented by non-tangible energy credits. These include carbon offsets, plastic credits, renewable energy credits, etc. The market for these products is created by the imperative placed upon governments and businesses to produce and consume clean zero-carbon energy. Environmental commodities are a gateway to launching meaningful sustainability programs and represent only one layer of a holistic strategy. The market is normally formed due to the cap-and-trade system: the government places an economy-wide cap on GHG emissions, reduced every year, and assigns individual polluting businesses with emission quotas. Any market instrument that allows businesses to benefit on the market from engaging in activity that reduces pollution by trading off this reduction to companies that pollute can be considered an environmental commodity.

Renewable Energy Credits

The most common environmental commodity is carbon offsets, which will be discussed in more detail later. Another major type of environmental commodity is Renewable Energy Credits (RECs), common in the United States, which represent the proof that 1 MWh of electricity was generated from an eligible renewable energy source. These are “market-based instrument that represents the property rights to the environmental, social, and other non-power attributes of renewable electricity generation.” (EPA, 2022) A subcategory of RECs is Solar Renewable Energy Credits (SRECs), generated specifically by solar power plants.

“RECs include several data attributes, including:

- Certificate data

- Certificate type

- Tracking system ID

- Renewable fuel type

- Renewable facility location

- Nameplate capacity of project

- Project name

- Project vintage (build date)

- Certificate (generation) vintage

- Certificate unique identification number

- Utility to which project is interconnected

- Eligibility for certification or renewable portfolio standard (RPS)

- Emissions rate of the renewable resource” (EPA, 2022)

RECs are used to keep track of the origin of electricity delivered to consumers, allowing them to substantiate renewable energy use claims. Unlike carbon offsets used to offset the GHG emissions from the company’s activity, RECs are used to reduce the portion of the emissions (carbon footprint) originating from electricity from the grid because the company can prove the electricity it used comes from a low- or zero-carbon source. Therefore, unlike carbon offsets, RECs do not require an additionality test because they are removing only the carbon footprint generated indirectly through electricity that would normally be produced from non-renewable sources. Purchasing RECs allows the company to guarantee its electricity comes exclusively from renewable energy sources and, therefore, does not generate the normal carbon footprint associated with typical electricity production, without the need to engage in renewable energy production. However, the purchase of RECs cannot reduce the carbon footprint generated through other company activities – this requires the purchase of carbon offsets (EPA, 2018).

Biomass Certificates

Biomass certificates can be considered a subcategory of RECs and are a part of voluntary and national certification schemes in both the United States and the EU that help ensure the sustainable production of biofuels, biomass fuels, and bioliquids. To do this, these programs check that (European Commission, 2022):

- “production of feedstock for these fuels does not take place on land with high biodiversity

- land with a high amount of carbon has not been converted for such feedstock production

- biofuel, bioliquid and biomass fuel production leads to sufficient greenhouse gas emissions savings”

Additional sustainability factors, like soil, water, and air protection, and community and social factors can be considered. The programs evaluate the complete production chain, from the farm that grows the feedstock to the biofuel production and trading.

European standard for compliance with sustainability criteria is:

- “feedstock producers comply with the sustainability criteria of the revised Renewable Energy Directive and its implementing legislation;

- information on the sustainability characteristics can be traced to the origin of the feedstock;

- all information is well documented;

- companies are audited before they participate in the scheme and retroactive audits take place regularly;

- the auditors have both the generic and specific auditing skills needed regarding the scheme’s criteria.” (European Commission, 2022)

The certificates are issued for five years.

While the EU does not have an official biomass certification program, it recognizes 13 such programs as compliant with its rules – the full list is available here: (European Commission, 2022). In the US, the largest programs are the Sustainable Biomass Program (SBP) and the Soy Sustainability Assurance Protocol (SSAP).

Waste Recycling Credits (WRC)

Waste Recycling Credits (WRCs), commonly known as plastic credits, are issued for the collection and recycling of waste from the environment. Each credit represents a ton of plastic waste that would otherwise remain in the environment. These credits are ultimately used by companies to offset their plastic waste footprint – they can be bought on the market and retired to offset one’s production of plastic waste.

Since they are not issued by government agencies, plastic credits are usually transferable only between users within the same issuing institution (typically NGOs or non-profit corporations). Each issuing institution has its own standards for verification, and there is no universally agreed-upon minimum standard. However, these instruments allow businesses to offset their plastic footprint when other means, like collection and recycling, are not enough to minimize the environmental impact of their operation.

Since this product is in its early stages, more work and cooperation are needed among the institutions to agree upon a common quality standard, evaluate the environmental impact of these credits, and allow free trading of plastic credits on the environmental commodities markets.

Carbon Credits/Offsets

Carbon offsets offer companies a gateway to launching meaningful sustainability programs that introduce potent carbon neutrality and social impact strategies. A carbon offset represents 1 ton of carbon dioxide equivalent (CO2e) removed from the environment or 1 t of CO2e of reduced emissions. Carbon offsets can be generated only by enhanced carbon sequestration performance compared to a hypothetical baseline scenario. There are multiple ways to earn carbon offsets: renewable energy projects, emissions capture, and storage improving energy efficiency, forestry initiatives, including preserving forests, etc. There is one common thread: the projects claim they would not have occurred if not for financing provided by carbon offset mechanisms. This means their contribution to carbon sequestration is in addition to what would have happened if this carbon offset financing were not in place (the baseline). This additionality and other methodological issues are evaluated and verified by a relevant standards organization. For instance, the UN Clean Development Mechanism (CDM) and Joint Implementation (JI) were created under the terms of the Kyoto Protocol, and their oversight bodies operated under the UN. However, in the voluntary markets, the role of the standards bodies is assumed by private sector operators.

A carbon credit represents a permit to emit one metric ton of CO2e, allowing governments to use them to regulate and limit greenhouse gas emissions. If a company emits less greenhouse gasses than permitted, it can earn a carbon credit for every ton of CO2e to make up that difference, which can be sold on the carbon market. If a company emits more than permitted, it must buy carbon offsets on the market to make up the difference. This mechanism is intended to keep the economy-wide emissions at or below a certain level, even though some individual companies may not adhere strictly to their assigned limits.

The standards bodies evaluate the claims of a carbon offset project, which must pass verification by an independent third-party auditor. After this verification and evaluation are complete, the project can be allowed to issue carbon offsets in the carbon exchange. The credits originating from carbon sequestration and those from emissions reduction are typically aggregated and then sold or traded on the voluntary carbon markets. Net emitters can achieve net-zero emissions by buying and then retiring the appropriate carbon offsets. Retiring carbon offsets removes them from the market, meaning the company that retired a carbon offset can claim to have removed 1 t of carbon dioxide equivalent from the atmosphere.

This strategy has become an increasingly popular tool among large multinational companies to reduce their carbon emissions, leading to rapid growth in the size of voluntary carbon markets. CORSIA, or the UN’s effort to mandate carbon offsetting by airlines for their emissions growth, makes it even more important to get carbon offset projects correct. CORSIA requires airlines to offset gains in their emissions after 2020, and when using the pre-COVID airline traffic increase predictions, this could result in ~4–20x multiples of demand for credits from the carbon market size today. Once implemented, CORSIA has the potential to be the biggest non-voluntary driver of carbon offset growth. By 2026, CORSIA expects to be solely responsible for ~400 MtCO2e worth of annual offsets. There will be a significant increase in credit demand in coming years if airline travel resumes to pre-pandemic levels.

However, to maintain carbon market stability and achieve long-term real emissions reduction, it is important to maximize the reliability of carbon offset projects, given the expected growth of voluntary carbon markets and the rapid increase in demand for carbon offsets. Forestry carbon represents the largest category of carbon offsets projects, representing the most issuances of new credits per year over the past decade. This is due to the perceived high reliability and the potential economic benefits of using wood for industrial production without releasing sequestered carbon.

However, these projects can have varied long-term reliability: forests are susceptible to forest fires, while industrial products containing wood are eventually discarded and the wood decomposes, releasing much of the sequestered carbon back into the atmosphere. Because this can occur over a long period masks the fact that the real long-term contribution of these projects to climate change mitigation can be significantly smaller than initially evaluated. A recent study suggests less than 20% of the credits sold in the California forest offset program correspond to additional carbon capture beyond what would be accomplished by natural processes (Marino, 2019; Haya, 2020). Therefore, rigorous verification and monitoring are required for all carbon-action projects.

Emissions Trading and Emissions Markets

An Emissions Trading System (ETS) is an artificial market to limit the total emissions of greenhouse gasses (GHG) or carbon dioxide (CO2). This system allows the implementation of market solutions to GHG emission reduction, utilizing market forces to achieve emission reductions at the lowest economic cost. Although this requires extensive regulation and quality control to avoid inflated estimates of emission reductions and to achieve real long-term emission reductions, it is a good way to utilize the free market to combat climate change. ETS are usually developed in cap-and-trade systems. The emissions cap is usually determined by national governments or legislatures and has typically decreased from one year to the next. The cap consists of emission credits, which are distributed during the initial allocation phase among the parties concerned by the regulations at the beginning of the reference period. The basic unit is typically 1 ton of CO2 equivalent (CO2e) of a greenhouse gas, which corresponds to 1 t of CO2 in its effect on global warming. There are more potent greenhouse gasses than CO2, where a smaller amount of emissions of these gasses is equated to 1 ton of CO2. If a particular greenhouse gas is less damaging than CO2, its 1 t of CO2e will equate to over 1 ton of emissions of that GHG.

At the end of each reference period, each participant must ‘surrender’ their allocated amount of emissions then canceled from their account. If a participant achieves lower emissions than the number of emission credits assigned, they can trade those surplus credits to the participants that failed to abide by their allocated emissions. This creates an effective mechanism for the trade of GHG emissions among participants in a free market.

The alternative form of ETS is baseline-and-credit. The baseline represents a reference emissions performance for participants, and the credits are then allocated as the difference regarding the baseline performance level. This scheme is at the base of some project-based crediting systems, like the Clean Development Mechanisms of the Kyoto Protocol and the REDD+. All operational national ETS are of the cap-and-trade form.

European Union formed an Emissions Trading System (ETS) in 2005, which was the first large-scale emissions trading system in the world. EU ETS includes all 27 EU member-states and three European Economic Area-European Free Trade Association (EEA-EFTA) states: Iceland, Liechtenstein, and Norway, and it has been linked to the Swiss ETS since 2021. Phase Four of EU ETS started on January 1st, 2021 and will end on December 31st, 2030.

EU-ETS covers around 40% of the EU’s total emissions and has been judged a great success: the proposed goal for 2020, a 21% emission reduction compared to 2005, was reached in 2014. After January 1st, 2021, the UK stopped being a part of EU-ETS, replacing it with its own UK ETS system.

The operating costs of EU ETS have been significantly lower than the expected 1% GDP, and some have suggested the costs could be eliminated or turned into positive economic impact with improved management and effective use of revenues. EU ETS has been a major driver in the overall reduction of greenhouse gas emissions in the EU, with an overall reduction of over 8% compared to 2005 emissions for the emitters covered by the EU ETS. The EU does not allow carbon offsets to be obtained under the EU ETS for carbon sinks due to uncertainties over their long-term viability and overall impact on greenhouse gasses and climate change.

Voluntary Markets

Voluntary carbon offset markets have become a vital tool for climate change mitigation by directing private capital into climate action projects not realized otherwise. In addition, voluntary carbon markets have the potential to provide a critical revenue stream to farmers and foresters who implement good land management practices.

There has been some regulatory uncertainty surrounding them lately because of the Paris Climate Agreement. However, this is nothing new for voluntary carbon markets since they have been dealing with regulatory uncertainty for as long as they have been around. Article 6 of the Paris Agreement determines whether countries can use voluntary carbon markets to meet their net-zero emissions targets. This creates a possibility of an international carbon market that would allow countries that exceed their targets to sell those surplus emissions to the countries that fail to meet theirs. Although this might suppress voluntary carbon markets because of the expansion of compliance markets, they will likely continue to be an important mechanism for emissions reduction.

Voluntary carbon markets are at a crucial tipping point. According to a nonprofit research group, “Demand for offsets generated through better management of forest, farms, and fields increased 264 percent over the past two years, leading to a seven-year high in the volume of voluntary carbon offsets.” (Zwick, 2019) McKinsey and The Taskforce on Scaling Voluntary Carbon Markets (TSVCM) estimate that the demand for carbon offsets will increase from the current $4 billion to more than $50 billion in 2030 and more than $350 billion by 2050 (McKinsey, 2021). The surge in demand for carbon offsets is attributable to voluntary initiatives from companies like airlines, oil companies, tech companies, and other large-scale businesses to achieve net carbon neutrality.

Recent research on a sample of S&P 500 and BRIC firms showed that “the positive association between firm value and voluntary carbon disclosure is stronger in developing countries. In addition, large emitters with sufficient carbon disclosure experience a less negative valuation than firms with inadequate carbon disclosure. Furthermore, a subcomponent analysis suggests that disclosing specific types of climate risk and opportunity is rewarded by investors and can mitigate the valuation penalty of carbon emissions.” (Jiang, 2021) This shows the economic benefits of voluntary transparency regarding the carbon footprint of private enterprises and that these effects are even stronger in developing countries.

Carbon Neutral Strategies — Carbon offsets are typically awarded as a difference between the performance of a carbon-action project and a hypothetical baseline performance – carbon emission reduction that would occur naturally with no financing or effort put towards it. This requires significant credit verification infrastructure for on-site monitoring, which is expensive and time-consuming. However, some alternatives can provide a different set of criteria to evaluate carbon capture projects (Brookings Institution, 2021). The LEAF (Lowering Emissions by Accelerating Forest Finance) project provides funds to regional governments (state or province) for public programs to manage and regulate all the forests on its territory. The baseline is the total historic level of carbon in the forests across the entire area, which is easier to estimate and less susceptible to annual fluctuations or local events.

This public-private partnership blueprint is both more cost-effective and more carbon-effective, resulting in higher quality carbon offsets produced by carbon-action projects conducted in the regulated area. This also reduces carbon leakage from economic activity shifting from the carbon-action project site to the neighboring sites.

The second general principle is to scale up the size of the projects monitored – instead of monitoring individual sites (like factories or plants), the monitoring should be performed at the company level and compare the company’s emissions to the industry average. Using industry sector averages as baselines would also naturally shift emission reduction goals, as the baseline emissions would naturally decline over time because of an overall economy-wide effort to reduce carbon emissions by introducing more efficient technologies or carbon capture.

The third principle is to prevent or discourage the “export” of carbon emissions, where companies can move high carbon-emitting plants or factories abroad and reap the benefits of reducing carbon emissions while making absolutely no impact on global emissions.

The fourth principle is to create uniform carbon offset verification standards and procedures that can be implemented worldwide and common regulatory standards for the voluntary carbon markets. This would ensure a more uniform quality of carbon offsets and make it easier to trade them on the international market. Common regulatory and verification frameworks would also allow carbon offsets to be transferred between different markets regardless of their geographical origin and would protect the integrity of these markets.

Farmers can sequester or reduce greenhouse gas emissions and generate carbon offsets through the adoption of regenerative agricultural practices shown to reduce emissions and have been widely used by environmentally minded producers. Access to carbon markets would allow them to reap additional economic benefits for implementing these practices, incentivizing their adoption. Voluntary carbon markets can also complement government conservation programs by directing private capital toward conservation practices through either private or public-private projects.

Although opportunities exist to trade offset credits, and corporate demand is high, relatively few producers and landowners have taken advantage of carbon markets to date. This is mostly due to high transaction costs including costs associated with monitoring, reporting, and verifying changes in soil and water quality. Small farms may lack the resources and knowledge to enter the market.

Additionally, significant questions remain surrounding the long-term environmental benefits of carbon sequestration practices and the integrity of offset projects. To ensure that such projects yield positive environmental outcomes, better tools are needed to measure soil carbon with scientific accuracy. These verification challenges continue to serve as major obstacles to the development of a more robust voluntary carbon market. However, if these challenges are overcome, it would encourage greater participation for both buyers and producers of carbon offsets and result in more extensive carbon sequestration.

Carbon Offset Projects

All carbon offset projects can be divided into two categories based on the mechanism by which they generate carbon offsets: emission avoidance and emission removal. Emission avoidance projects prevent GHG emissions that would occur through regular activity, while emission removal projects capture GHGs produced through regular activity and prevent them from reaching the atmosphere. However, this is a broad delineation of projects. It is more common to separate them based on the activity the carbon offset project is looking to address:

– Forestry and Conservation

– Agricultural Projects

– Renewable Energy

– Greenhouse Gas Capture and Removal/Destruction

– Community Projects / Energy efficiency

– Waste to Energy

Forestry and conservation projects mostly focus on GHG removal through reforestation or conservation of forests otherwise exploited for fuel (firewood) or raw materials. Carbon offsets are generated based either on the growth of new trees, which removes atmospheric carbon and converts it into biomass, or the preservation of the biomass of the old existing trees. These are popular, but the carbon credits generated this way can be unreliable for reasons discussed in the next section, requiring rigorous auditing and monitoring.

Agricultural projects rely on eliminating GHG emissions from agricultural production using carbon farming techniques that either preserve the carbon content of the soil or increase it, resulting in overall negative CO2e emissions. These techniques often fall under agroforestry and regenerative agriculture and can regularly generate carbon offsets by sequestering carbon in the soil and the agricultural produce. These projects can generate negative emissions of around one tCO2e per acre of agricultural land (2.2 tCO2 per hectare) while also providing economic benefits through higher quality products and increased economic resilience of such farms from product diversification. However, due to the ease with which carbon sequestered in the soil can be released by changes in agricultural practices or natural disasters, these projects require regular auditing and soil analysis.

Renewable energy projects focus on developing new renewable energy production capacities that would not have been built without the additional funding provided by these projects. They typically include solar, wind, or hydroelectric power and generate carbon offsets by replacing fossil fuel energy production (and the related CO2e emissions) with clean renewable energy sources. Besides the elimination of CO2e emissions, these projects have significant local socio-economic benefits, as they provide jobs, decrease reliance on fossil fuels (which many countries import, increasing the resulting CO2e footprint), and improve regional economic resilience.

Greenhouse gas capture and removal/destruction projects focus on preventing the industrial emission of greenhouse gasses through capture and either storing them (in the case of CO2) or converting/destroying them (in the case of high-potency gasses like N2O and hydrofluorocarbons (HFCs)). These projects earn carbon offsets through emission avoidance by preventing GHGs from being emitted into the atmosphere. The quality of these projects can vary, and those involving permanent storage of captured gas involve a risk of a future release of captured GHGs, which would negate any effects on climate change. Therefore, proper quality control and oversight are required with this project.

Community projects include a wide variety of projects focused on reducing the carbon footprint of a community’s activities, mostly through the introduction of energy-efficient methods. These can include things like providing water and sanitation, improving home insulation, modernization of electrical grids to reduce losses, etc. In developed societies, similar effects can be achieved with work-from-home programs, replacement of outdated vehicles and appliances, and infrastructure projects focusing on applying energy-efficient technologies. All these projects provide communities with improved conditions, improve energy efficiency, and reduce CO2e emissions, providing both socio-economic benefits and making an impact against climate change.

Waste-to-energy projects focus on converting waste that would normally end up in a landfill and emit GHGs through decomposition to fuel that can produce energy. These projects earn carbon offsets through both the elimination of CO2e emissions from the waste and the replacement of fossil fuel energy emissions with energy produced from the waste. This means either using waste as a direct fuel in the incinerators or capturing the methane gas released in the landfill by waste decomposition and using it as a fuel. These projects can also have an additional impact on low-income communities that rely on firewood for energy by replacing energy from firewood with energy from waste. This preserves the local forests otherwise sourced for firewood, boosting the local economy with jobs and lowering air pollution.

Carbon Markets and Lessons from Projects in Latin America and Southeast Asia

Latin America and Southeast Asia account for the largest share of global carbon emissions reduction projects. In Latin America, most projects were conducted to preserve the Amazon rainforests, which has been partially successful. Although deforestation of the Amazon is still ongoing, these projects have been able to significantly slow down its rate to less than half from its peak in the early 2000s. This can be attributed mostly to REDD+ conservation projects and other carbon offset contributions.

However, despite this success, many forestry projects in Latin America have failed to deliver on the planned carbon sequestration set out at the beginning. There has been a myriad of issues that plagued these projects, reducing their effectiveness: lack of cooperation from the local governments and communities, insufficient funding, and carbon leakage. But these projects provide a baseline for future projects, allowing a more accurate estimation of realistic carbon sequestration effects, and the local issues encountered allow future projects to be conducted in localities where forests can be protected more effectively to deliver the promised carbon offsets. Otherwise, the agreed GHG emissions reductions won’t materialize.

A good example of the mixed success of forestry projects has been the Brazilian state of Acre. This has been a popular destination for forest conservation projects, with the provincial government agreeing on projects with multiple companies and organizations in the UK and Germany (ScienceDaily 2019). These projects often target poorer communities for project infrastructure maintenance to provide additional social benefits. California’s ETS has been accepting projects from Acre since September 2019 although the EU ETS has not done so.

Unfortunately, some of these projects have failed to deliver on the promised carbon emissions reduction, highlighting the potential drawbacks and issues that need to be addressed in future projects. An analysis by the Norwegian government of the Amazon deforestation prevention projects indicates there are no effective follow-up mechanisms in place to prevent carbon leakage or relocation of logging operations. The local governments have failed to track and report the changes in rainforest land coverage and degradation, especially considering that logging releases some of the carbon sequestered in trees during their lifetime, reducing the real impact of these carbon offsets on climate change.

This example highlights the inherent unreliability of forestry projects, which depend highly on the cooperation and effectiveness of the local government and the support of local communities. This is why forestry projects account for a relatively small share of carbon offsets in the international carbon markets even though, on paper, they should have significantly more potential. Therefore, dependable mechanisms for project evaluation and monitoring are needed to make forestry projects more successful and widespread, not just regarding the size of the forest carbon sinks, but also to make sure that these forests remain healthy and that the carbon remains sequestered in the trees. Most of these projects are conducted in developing countries that lack the infrastructure to conduct monitoring and due diligence on these projects, although the increasing demand for carbon offsets on the international markets has stimulated the players in this space to take steps in the right direction to remedy this.

Therefore, it is natural to seek methods that would represent a more reliable long-term carbon sequestration option to complement forestry projects. Agroforestry, as a component of regenerative agriculture, offers an alternative route to expanding the forest/tree coverage while providing economic benefits and lasting climate mitigation. Net negative emission regenerative farms provide these benefits: carbon is sequestered in the farm’s produce/plants and the soil, mitigating the risk of potential unwanted release, and giving a more reliable account of actually sequestered carbon, and its impact on atmospheric carbon and climate change. This makes regenerative agriculture an ideal complement to tree planting activities, providing a more reliable guarantee that the investment in carbon sequestration will pay off through the mitigation of climate change.

Southeast Asia also holds significant potential for carbon sequestration and deforestation prevention projects: 15% of the world’s tropical forests are in this region with a deforestation rate of 1.2% per year – the highest in the world. This offers a significant economic opportunity to expand carbon markets and carbon projects in Southeast Asia, and it is estimated that the carbon market in this region will reach $10 billion by 2030. However, South Asian carbon markets face gross inefficiencies and significant scalability issues. There are four major challenges these carbon markets must overcome:

– Regulatory obstacles

– Market integrity

– Increasing supply

– Infrastructure

National governments and ASEAN have yet to agree on a consistent set of policies and regulations that could help unify regulatory frameworks across the region, which makes it easier for foreign capital to access these markets and develop carbon projects. In addition, the quality of carbon offsets from the ASEAN region varies significantly in quality, reducing buyer confidence. The main cause of this is poor onsite monitoring due to high cost, leading to a lax credit verification process and significant carbon leakage. Another major obstacle to making SE Asian carbon markets more effective has been generally poor support infrastructure for carbon markets, which is typical of immature markets. This can be addressed by standardizing margins, increasing market efficiencies, and improving access to high-quality offsets. Finally, given the rapid increase in demand for carbon offsets, SE Asian carbon markets need to attract more carbon projects into the region. This is hampered by long project lead times (three to seven years) and a lack of private and non-governmental involvement. The ASEAN region requires more public-private partnerships and higher involvement from non-governmental organizations.

However, there is also significant potential for carbon-action projects either private or through public-private partnerships in developed regions of the world. The Environmental Protection Agency estimates that land use and forestry in the United States produce a carbon sink of 799 million metric tons annually (offsetting 12 percent of all U.S. emissions), which indicates significant opportunities to expand carbon sequestration through improved agriculture, forestry, and land management (EPA, 2021). There are also significant inefficiencies in agricultural production that could be exploited to reduce its carbon footprint and achieve significant reductions in carbon emissions.

But it is important that proper monitoring, auditing, and evaluation are conducted on carbon offset projects. A recent study revealed systematic over-crediting in California’s forest carbon offset program, showing that a lack of integrity can be found in the projects in developed nations: “Here, we evaluate the design of California’s prominent forest carbon offsets program and demonstrate that its climate-equivalence claims fall far short based on directly observable evidence. By design, California’s program awards large volumes of offset credits to forest projects with carbon stocks that exceed regional averages. This paradigm allows for adverse selection, which could occur if project developers preferentially select forests ecologically distinct from unrepresentative regional averages. By digitizing and analyzing comprehensive offset project records alongside detailed forest inventory data, we provide direct evidence that comparing projects against coarse regional carbon averages has led to systematic over-crediting of 30.0 million tCO2e (90% CI: 20.5–38.6 million tCO2e) or 29.4% of the credits we analyzed (90% CI: 20.1%–37.8%). These excess credits are worth an estimated $410 million (90% CI: $280–$528 million) at recent market prices. Rather than improve forest management to store additional carbon, California’s forest offsets program creates incentives to generate offset credits that do not reflect real climate benefits.” (Badgley, 2021)

Thus, providers of credits will need to ensure quality, appropriate funding, and cooperation with local institutions to meet the growing demand for these key instruments in the fight against climate change and focus on corporate social responsibility.

Latest Carbon Capture Technology Developments/Advances

As a part of the growing sense of urgency among the policymakers to address climate change, there has been a significant commitment to invest in the measures to reverse the climate change effects and develop new technologies to facilitate this effort.

“The U.S. Department of Energy (DOE) today released a Notice of Intent (NOI) to fund the Bipartisan Infrastructure Law’s $3.5 billion program to capture and store carbon dioxide (CO2) pollution directly from the air. The Regional Direct Air Capture Hubs program will support four large-scale, regional direct air capture hubs that each comprise a network of carbon dioxide removal (CDR) projects to help address the impacts of climate change, creating good-paying jobs and prioritizing community engagement and environmental justice. In addition to efforts to deeply decarbonize the economy through methods like clean power, efficiency, and industrial innovation, the widespread deployment of direct air capture technologies and CO2 transport and storage infrastructure plays a significant role in delivering on President Biden’s goal of achieving an equitable transition to a net-zero economy by 2050.” (DOE, 2022)

Other developed countries, including the EU, have initiated large zero-carbon initiatives in a wide range of sectors, intending to eliminate GHG emissions by 2050.

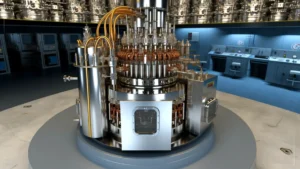

Recently, there have been several technological advances that provide further inroads toward addressing the needs of the zero-carbon economy. Carbon Capture and Utilization (CCU) technologies take carbon dioxide out of the atmosphere, either capturing it directly from the air or absorbing it at polluting sources, and put it to use in processes such as making fuel, plastics, and concrete. Unlike CCS technology, which stores captured carbon, CCU technologies either use energy to convert CO2 into fuels or utilize it in other industrial processes like oil extraction or growing plants.

Kiane de Kleijne and her colleagues at Radboud University in the Netherlands analyzed 40 CCU processes against three criteria: permanent CO2 storage; the origin of the CO2 collected (atmospheric and natural sources); and the carbon footprint of the process itself. The team helmed by Rosalie van Zelm and Heleen de Coninck found that the majority of CCU processes failed on at least one criterion, with 32 of the 40 emitting more CO2e than they captured. Only four methods readily applied while also having low CO2e emissions. These include technologies using CO2 in concrete production and oil extraction:

“This paper investigates which CCU technologies, using atmospheric, biogenic, or fossil CO2, are Paris compatible, based on life cycle emissions and technological maturity criteria. We systematically gathered and harmonized CCU technology information for both criteria and found that CCUs with technology readiness levels (TRLs) of 6 or higher can be Paris compatible in 2030 for construction materials, enhanced oil recovery, horticulture industry, and some chemicals. For 2050, considering all TRLs, we showed that only products storing CO2 permanently or produced from only zero-emissions energy can be Paris compatible. Our findings imply that research and policy should focus on accelerating the development of CCU technologies that may achieve (close to) zero net emissions, avoiding lock-in by CCU technologies with limited net emission reductions.” (de Kleijne, 2022)

This research highlights the need for careful consideration of investment into climate change technology and projects and the need to consider the long-term prospects of the technology used and realistically estimate the impact of the project using this technology on GHG emissions. Investment into technology that brings only limited benefits could fail to bring both environmental and economic benefits required to reach the net-zero goal by 2050 while depriving alternative, more effective projects of funding. It also stresses the need to publicly promote promising, effective technology that could form the backbone of the climate change response for the next few decades.

Carbon capture and utilization and storage (CCUS) technology has been used to remove CO2 from industrial processes to make chemicals or store it underground. Some 40 million tons of CO2 emissions are already captured annually, and the planned worldwide figure is expected to increase to 140 million tons of CO2 in the next few years. However, current annual global CO2e emissions are around 35 billion tons. The U.S. Department of Energy projects that, by 2035, the cost of CCUS per ton of CO2 needs to fall from $58 to around $30 per ton for this technology to remain a viable economic option. This requires new technology to be developed. The most common type of carbon capture technology uses amines dissolved in water, which react chemically with CO2 to remove it from the atmosphere. However, the amines then need to be chemically regenerated to be used again, which requires evaporation and recondensation of the water, an energy-intensive process. New carbon capture materials are “water lean”, containing only a little water, making the process less expensive energetically.

A new study reported in November 2020 in Energy & Environmental Science describes a new solvent molecule called 2-EEMPA. Although 2-EEMPA was designed as too complex CO2 as a zwitterionic carbamate, where both 2-EEMPA molecules bind to CO2. However, this study suggests that, when CO2 binds to 2-EEMPA, it forms either a regular carbamate or bicarbonate, although the reaction stoichiometry is still 2:1. This reduces the energetic cost of regenerating 2-EEMPA by around 19%, and economic projection shows that the use of 2-EEMPA in a carbon capture plant would reduce the cost of CO2 capture to around $50.6 per tonne of CO2. “Techno-economic analyses (TEA) showed that the proposed integrated process can improve the thermal efficiency by 5 % and reduce the total capital investment and minimum synthetic natural gas (SNG) selling price by 32 % and 12 %, respectively, compared to the conventional Sabatier process, highlighting the energetic and economic benefits of integrated capture and conversion.” (Science Magazine, 2021; Zheng, 2020; Kothandaraman, 2021)

A team led by Dr. Singh uses electrodialysis to capture CO2. The method includes using the electric field to transport ions across charged membranes, and it is a commonly used desalination method. Here, a solution of potassium hydroxide (KOH) in ethylene glycol and water are separated by a charged membrane and, when air or flue gas is injected into the KOH solution, the OH- reacts with CO2 to form HCO3- ions, capturing CO2 in the solution. The hydroxide ions in the KOH solution are replenished by the water passing by the charged cathode, while HCO3- ions move through the membrane towards the anode, where the electrochemical reaction converts them back to CO2 and water. CO2 can then safely be captured for storage or utilization.

It is estimated that CO2 can be captured at a 100 times higher rate with this technology than with other state-of-the-art technologies. A large-scale system would operate at $145 per tCO2e with a capture capacity of 1,000 metric tons/h of CO2. This is significantly cheaper than the current carbon capture plants in operation or the DOE targets for carbon capture facilities (C&EN, 2022; Prajapati, 2022).

Northumbria University’s team of researchers developed a system to convert sunlight, water, and carbon dioxide into acetate and oxygen – where acetate can be a precursor in the chemical industry. The process uses bacteria grown on a synthetic semiconductor device (photocatalyst sheet), allowing its use with no infrastructure in place (Wang, 2022; Science Daily, 2022).

Carbon Offsets and Environmental Commodities for Small and Medium Enterprises

Based on the location, the project, and the support infrastructure, carbon offset and other environmental commodities produced can be of different qualities and prices. This is why it is important for small and medium businesses to partner with offset providers that offer reliable, high-quality projects that produce long-term or permanent carbon offsets that will make a long-term difference in the fight against climate change.

There are reliable carbon offset providers that cater to individuals, businesses, and several business-focused providers, offering relatively high-quality projects. Some are focused on offsetting any business or human activity, while others focus on a particular type of activity like travel or e-commerce.

However, some characteristics are typical of a reliable provider:

- A provider is a certified B corp

- Third-party verification of its carbon offset projects

- Transparency

These signal to a business or an individual that the carbon offset provider offers relatively reliable service and provides a real opportunity to offset one’s carbon footprint. B Corporation, or B corp, is a private certification that grades companies for their “social and environmental performance.” Unlike the official “benefit corporation” designation that applies to non-profits, this certification applies to for-profit companies. To achieve B Corp certification, a company must score at least 80 out of 200 in an assessment that evaluates the company’s positive impact on corporate governance, labor relations, community, the environment, and the goods and/or services offered by the company. Depending on the company size and activities, these categories are weighted to reflect the challenges unique to that company. The certification also requires a certain amount of corporate transparency, and the companies must integrate their stakeholder interests into their governing documents.

To produce any environmental commodity any project must move through several distinct phases:

- Planning phase: project development, third-party validation, and registration with the appropriate government institution or a non-government-operated registry

- Implementation phase: project execution, third-party verification (sometimes requires verification by both government agency and third-party independent verification), credit issuance

- Use of issued credit: once the environmental commodity is created by credit issuance, it can be traded or retired to offset other company activities

A business can enter this process at any stage listed above, including by simply buying environmental commodities on the open market or directly from an organization providing carbon-action projects. To ensure high quality of carbon offsets and other environmental commodities, businesses should verify that the project that generates offsets meets these criteria:

- Additionality: the project must provide clear evidence that the offsets produced would not have been produced anyway or that they will not be generating additional pollution or emission in neighboring regions or through other activities

- Accurate estimation: the provider should fairly and accurately evaluate the environmental impact of their project and not try to inflate its value; there are several ways project’s value can be overestimated: overestimating baseline emissions, underestimating post-project emissions, not accounting for indirect effects on emissions, forward crediting for expected future emission savings rather than measured real savings

- Permanence: there are events that can release sequestered carbon back into the atmosphere annulling the sequestration effects and making the resulting carbon offsets worthless

- Not claimed by another entity: avoiding double counting of offsets is crucial to maintaining their positive environmental effects

- Social and environmental integrity: the project should not inflict social or environmental harm

There are several ways businesses can make sure their offsets make a valuable impact on the environment: discounting offsets (discounting their estimated value internally), using low-risk projects, and offset due diligence (vetting offset projects and offset provider’s track record). This can ensure your business operates with no environmental footprint.

Conclusion

Environmental commodities are a rapidly growing class of market and financial instruments aimed at supporting measures for the reduction of greenhouse gas emissions and pollution. Their main purpose is two-fold: to allow businesses to comply with GHG emission targets within the Paris Climate Agreement national obligations and allow businesses that wish to invest in eliminating the negative effects of their activities on the environment to do so in a relatively easy manner.

Other than the markets for GHG emissions, the markets for environmental commodities are still developing and most of the trading is conducted directly and not through institutional intermediaries. Carbon markets for GHG emissions are much more developed and have been operating successfully for over a decade. This suggests that the markets for other environmental commodities will probably reach that level of development soon, or that these commodities will eventually be added to the carbon markets to create a single environmental commodities market. However, to reach this goal, global standards for each environmental commodity evaluation, and verification must be developed and agreed upon and effective auditing and verification mechanisms need to be established. This issue is still plaguing the much more developed carbon markets, highlighting the need to promote reliable market participants and credit providers for all environmental commodities products. Projects in both developed and developing countries have been found to produce low-quality credits, overestimate the true effects on total GHG emissions, or cause social or environmental damage. Therefore, much more rigorous verification and auditing of environmental commodities projects must establish and maintain high standards to ensure that these projects have a real impact on climate change and improve and protect the environment.

Given the climate emergency humanity is facing, the carbon markets can have the largest potential influence on the future of human civilization, being one of the main tools to achieve zero-carbon goals by 2050. One of the main technologies expected to achieve these goals is carbon capture, utilization, and storage (CCUS), which has failed to deliver the expected results given that its huge relevance to climate goals has long been recognized. Development of effective methods has been slow, and these methods have also been deployed slowly and sparingly: CCUS accounts for less than 0.5% of global investment in clean energy and energy efficiency technologies.

However, recent developments and large government investments in the US, the EU, and globally have changed this. An estimated $27 billion worth of projects have reached planning stages, and over 30 new CCUS facilities have been announced five years. This represents double the investment total over the past decade. CCUS technologies have massive advantages: it can be retrofitted to existing power and industrial plants, tackle emissions in almost every sector, even when other options are unavailable, and it enables low-cost low-carbon hydrogen production. It gives an option to abate emissions that would otherwise be impossible to reduce or eliminate. Therefore, CCUS technologies represent a lynchpin of global climate change mitigation efforts.

References

Badgley, G., Freeman, J., Hamman, J.J., Haya, B., Trugman, A.T., Anderegg, W.R. and Cullenward, D., 2022. Systematic over‐crediting in California’s forest carbon offsets program. Global Change Biology, 28(4), pp.1433-1445.

Chao, C., Deng, Y., Dewil, R., Baeyens, J. and Fan, X., 2021. Post-combustion carbon capture. Renewable and Sustainable Energy Reviews, 138, p.110490.

C&EN, 2022, Ultrafast technology could slash carbon capture costs, Available at: https://cen.acs.org/environment/climate-change/Ultrafast-technology-slash-carbon-capture/100/i7

de Kleijne, K., Hanssen, S.V., van Dinteren, L., Huijbregts, M.A., van Zelm, R. and de Coninck, H., 2022. Limits to Paris compatibility of CO2 capture and utilization. One Earth, 5(2), pp.168-185.

DOE, 2022, Biden Administration Launches $3.5 Billion Program To Capture Carbon Pollution From The Air, Available at: https://www.energy.gov/articles/biden-administration-launches-35-billion-program-capture-carbon-pollution-air-0

EPA, 2022, Renewable Energy Certificates, Available at: https://www.epa.gov/green-power-markets/renewable-energy-certificates-recs

EPA, 2018, Guide to Carbon Offsets and Renewable Energy Certificates, Available at: https://www.epa.gov/sites/default/files/2018-03/documents/gpp_guide_recs_offsets.pdf

European Commission, 2022, Bioenergy – Voluntary Schemes, Available at: https://energy.ec.europa.eu/topics/renewable-energy/bioenergy/voluntary-schemes_en

Garcia‐Garcia, G., Fernandez, M.C., Armstrong, K., Woolass, S. and Styring, P., 2021. Analytical Review of Life‐Cycle Environmental Impacts of Carbon Capture and Utilization Technologies. ChemSusChem, 14(4), pp.995-1015.

Global Carbon Budget, 2021, by Pierre Friedlingstein, Matthew W. Jones, Michael O’Sullivan, Robbie M. Andrew, Dorothee C. E. Bakker, Judith Hauck, Corinne Le Quéré, Glen P. Peters, Wouter Peters, Julia Pongratz, Stephen Sitch, Josep G. Canadell, Philippe Ciais, Rob B. Jackson, Simone R. Alin, Peter Anthoni, Nicholas R. Bates, Meike Becker, Nicolas Bellouin, Laurent Bopp, Thi T. T. Chau, Frédéric Chevallier, Louise P. Chini, Margot Cronin, Kim I. Currie, Bertrand Decharme, Laique Djeutchouang, Xinyu Dou, Wiley Evans, Richard A. Feely, Liang Feng, Thomas Gasser, Dennis Gilfillan, Thanos Gkritzalis, Giacomo Grassi, Luke Gregor, Nicolas Gruber, Özgür Gürses, Ian Harris, Richard A. Houghton, George C. Hurtt, Yosuke Iida, Tatiana Ilyina, Ingrid T. Luijkx, Atul K. Jain, Steve D. Jones, Etsushi Kato, Daniel Kennedy, Kees Klein Goldewijk, Jürgen Knauer, Jan Ivar Korsbakken, Arne Körtzinger, Peter Landschützer, Siv K. Lauvset, Nathalie Lefèvre, Sebastian Lienert, Junjie Liu, Gregg Marland, Patrick C. McGuire, Joe R. Melton, David R. Munro, Julia E. M. S. Nabel, Shin-Ichiro Nakaoka, Yosuke Niwa, Tsuneo Ono, Denis Pierrot, Benjamin Poulter, Gregor Rehder, Laure Resplandy, Eddy Robertson, Christian Rödenbeck, Thais M. Rosan, Jörg Schwinger, Clemens Schwingshackl, Roland Séférian, Adrienne J. Sutton, Colm Sweeney, Toste Tanhua, Pieter P. Tans, Hanqin Tian, Bronte Tilbrook, Francesco Tubiello, Guido van der Werf, Nicolas Vuichard, Chisato Wada, Rik Wanninkhof, Andrew Watson, David Willis, Andrew J. Wiltshire, Wenping Yuan, Chao Yue, Xu Yue, Sönke Zaehle, and Jiye Zeng (2021), Earth System Science Data, DOI: 10.5194/essd-2021-386. PreprintIEA, 2008a. Energy technology perspectives 2008: Scenarios and Strategies to 2050. IEA/OECD, Paris, France.

IEA, 2008b. CO2 capture and storage: A Key Abatement Option, IEA/OECD, Paris, France.

IEA, 2009. Technology roadmap – carbon capture and storage. International Energy Agency, Paris, France.

IEA/UNIDO, 2011. [Technology roadmap – Carbon capture and storage in industrial applications]. International Energy Agency, Paris, France.

IEA, 2020, CCUS in Clean Energy Transitions, IEA, Paris https://www.iea.org/reports/ccus-in-clean-energy-transitions

IEA, 2021a, Global Pipeline of Commercial CCUS Facilities, Available at: https://www.iea.org/data-and-statistics/charts/global-pipeline-of-commercial-ccus-facilities-operating-and-in-development-2010-2021

IEA, 2021b, Large Scale CCUS projects in Development, Available at: https://www.iea.org/data-and-statistics/charts/large-scale-ccus-projects-in-development-worldwide-by-application-and-storage-type

IEA, 2021c, Share of Activity Covered by Corporate Carbon Neutral Targets in Select Sectors, Available at: https://www.iea.org/data-and-statistics/charts/share-of-activity-covered-by-corporate-carbon-neutral-targets-in-select-sectors-with-an-identified-role-for-ccus

IPCC, 2005. Special report on carbon dioxide capture and storage. Metz, B. and Davidson, O. and Coninck, H.C.De and Loos, M. and Meyer, L.A. (eds.). Cambridge University Press, Cambridge, United Kingdom, and New York, USA, pp. 442.

Kárászová, M., Zach, B., Petrusová, Z., Červenka, V., Bobák, M., Šyc, M. and Izák, P., 2020. Post-combustion carbon capture by membrane separation, Review. Separation and Purification Technology, 238, p.116448.

Kikkawa, S., Amamoto, K., Fujiki, Y., Hirayama, J., Kato, G., Miura, H., Shishido, T. and Yamazoe, S., 2022. Direct Air Capture of CO2 Using a Liquid Amine–Solid Carbamic Acid Phase-Separation System Using Diamines Bearing an Aminocyclohexyl Group. ACS Environmental Au.

Kothandaraman, J., Saavedra Lopez, J., Jiang, Y., Walter, E.D., Burton, S.D., Dagle, R.A. and Heldebrant, D.J., 2021. Integrated Capture and Conversion of CO2 to Methane Using a Water‐lean, Post‐Combustion CO2 Capture Solvent. ChemSusChem, 14(21), pp.4812-4819.

Liang, Z.H., Rongwong, W., Liu, H., Fu, K., Gao, H., Cao, F., Zhang, R., Sema, T., Henni, A., Sumon, K. and Nath, D., 2015. Recent progress and new developments in post-combustion carbon-capture technology with amine-based solvents. International Journal of Greenhouse Gas Control, 40, pp.26-54.

Majumdar, S., Tokay, B., Martin-Gil, V., Campbell, J., Castro-Muñoz, R., Ahmad, M.Z. and Fila, V., 2020. Mg-MOF-74/Polyvinyl acetate (PVAc) mixed matrix membranes for CO2 separation. Separation and Purification Technology, 238, p.116411.

Mckinsey & Company, 2008. Carbon capture and storage: Assessing the economics. Available at: http://www.mckinsey.com/clientservice/ccsi/pdf/ccs_assessing_the_economics.pdf

Menon, S., Denman, K.L., Brasseur, G., Chidthaisong, A., Ciais, P., Cox, P.M., Dickinson, R.E., Hauglustaine, D., Heinze, C., Holland, E. and Jacob, D., 2007. Couplings between changes in the climate system and biogeochemistry (No. LBNL-464E). Lawrence Berkeley National Lab.(LBNL), Berkeley, CA (United States).

Parliamentary Office of Science and Technology, 2009. Postnote 335 – carbon capture and storage. The Parliamentary Office of Science and Technology, London, United Kingdom. Available at: http://www.parliament.uk/documents/upload/postpn335.pdf

Petersen, H.A., Alherz, A.W., Stinson, T.A., Huntzinger, C.G., Musgrave, C.B. and Luca, O.R., 2022. Predictive energetic tuning of C-Nucleophiles for the electrochemical capture of carbon dioxide. Iscience, 25(4), p.103997.

Prajapati, A., Sartape, R., Rojas, T., Dandu, N.K., Dhakal, P., Thorat, A.S., Xie, J., Bessa, I., Galante, M.T., Andrade, M.H. and Somich, R.T., 2022. Migration-assisted, moisture gradient process for ultrafast, continuous CO 2 capture from dilute sources at ambient conditions. Energy & Environmental Science, 15(2), pp.680-692.

Regufe, M.J., Pereira, A., Ferreira, A.F., Ribeiro, A.M. and Rodrigues, A.E., 2021. Current developments of carbon capture storage and/or utilization–looking for net-zero emissions defined in the Paris agreement. Energies, 14(9), p.2406.

Savage, M., Yang, S., Suyetin, M., Bichoutskaia, E., Lewis, W., Blake, A.J., Barnett, S.A. and Schröder, M., 2014. A Novel Bismuth‐Based Metal–Organic Framework for High Volumetric Methane and Carbon Dioxide Adsorption. Chemistry–A European Journal, 20(26), pp.8024-8029.

Science Magazine, 2021, New generation of carbon dioxide traps could make carbon capture practical, Available at: https://www.science.org/content/article/new-generation-carbon-dioxide-traps-could-make-carbon-capture-practical

Viebahn, P. and Nitsch, J. and Fischedick, M. and Esken, A. and Schuwer, D. and Supersberger, N. and Zuberbuhler, U. and Edenhofer, O., 2007. Comparison of carbon capture and storage with renewable energy technologies regarding structural, economic, and ecological aspects in Germany. International Journal of Greenhouse Gas Control 1 (1), pp. 121-133.

Wang, Q., Kalathil, S., Pornrungroj, C., Sahm, C.D. and Reisner, E., 2022. Bacteria–photocatalyst sheet for sustainable carbon dioxide utilization. Nature Catalysis, 5(7), pp.633-641.

Wilberforce, T., Olabi, A.G., Sayed, E.T., Elsaid, K. and Abdelkareem, M.A., 2021. Progress in carbon capture technologies. Science of The Total Environment, 761, p.143203.

Yang, F., Meerman, J.C. and Faaij, A.P.C., 2021. Carbon capture and biomass in industry: A techno-economic analysis and comparison of negative emission options. Renewable and Sustainable Energy Reviews, 144, p.111028.

Zapp, P., Schreiber, A., Marx, J., Haines, M., Hake, J., Gale, J., 2012. Overall environmental impacts of CCS technologies—A life cycle approach. International Journal of Greenhouse Gas Control 8 (2012) 12–21

ZEP, 2013. “CO2 Capture and Storage (CCS) in energy-intensive industries – An indispensable route to an EU low-carbon economy”, European Technology Platform for Zero Emission Fossil Fuel Power Plants, Brussels.

Zheng, R.F., Barpaga, D., Mathias, P.M., Malhotra, D., Koech, P.K., Jiang, Y., Bhakta, M., Lail, M., Rayer, A.V., Whyatt, G.A. and Freeman, C.J., 2020. A single-component water-lean post-combustion CO 2 capture solvent with exceptionally low operational heat and total costs of capture–comprehensive experimental and theoretical evaluation. Energy & Environmental Science, 13(11), pp.4106-4113

Q & A with the Author

What is an Environmental Commodity?

An environmental commodity is a market-based instrument that represents a specific quantity of environmental attributes, benefits, or credits associated with the reduction of environmental pollutants or the enhancement of environmental quality. These commodities are created through regulatory frameworks or voluntary programs to address environmental challenges, such as climate change and pollution. They can be traded, bought, or sold, providing financial incentives for companies and individuals to engage in environmentally beneficial practices.

What are Examples of Commodities?

Commodities are basic goods or raw materials used in commerce, typically natural resources or agricultural products, that are interchangeable with other goods of the same type. Examples of commodities include:

- Agricultural commodities: Wheat, corn, soybeans, rice, and cotton.

- Energy commodities: Crude oil, natural gas, gasoline, and coal.

- Metal commodities: Gold, silver, copper, aluminum, and platinum.

- Environmental commodities: Carbon credits, renewable energy certificates (RECs), and water rights.

Are Carbon Credits Environmental Commodities?

Yes, carbon credits are a type of environmental commodity. A carbon credit represents the right to emit one metric tonne of carbon dioxide or the equivalent amount of a different greenhouse gas. Carbon credits are created through projects that reduce, avoid, or sequester emissions, such as reforestation projects, renewable energy installations, or methane capture from landfills. They can be traded in carbon markets, allowing companies and governments to offset their emissions by purchasing credits from entities that have achieved emissions reductions beyond their targets.

What are the 4 Commodities?

When discussing commodities in a general context, they are often categorized into four main types:

- Energy: Includes crude oil, natural gas, gasoline, and heating oil. Energy commodities are essential for powering industries, transportation, and households.

- Metals: Both precious metals (like gold, silver, and platinum) used for investment and industrial metals (like copper, aluminum, and steel) used in construction, manufacturing, and technology.

- Agricultural: Comprises food crops (like wheat, corn, and soybeans), livestock (such as cattle and hogs), and soft commodities (like coffee, sugar, and cotton) used for food, clothing, and other products.

- Environmental: This category includes market-based instruments like carbon credits, renewable energy certificates (RECs), and water rights, which are traded to incentivize or regulate environmental impacts.

What is an example of carbon neutral?

An example of carbon neutrality can be seen in businesses or countries that offset their carbon dioxide emissions to achieve a net-zero carbon footprint. One practical example is a company that operates in a way where the total amount of carbon dioxide emissions produced is completely offset by renewable energy initiatives and carbon offset projects such as reforestation or investing in carbon capture and storage technologies. For instance, a tech company might power all its data centers with renewable energy sources like wind or solar power, and invest in reforestation projects to offset the emissions from its corporate vehicles, thereby aiming to balance out its carbon footprint to achieve carbon neutrality.

What is carbon neutrality UN?

Carbon neutrality, as outlined by the United Nations, refers to achieving a balance between emitting carbon and absorbing carbon from the atmosphere in carbon sinks. The UN’s definition emphasizes the importance of reducing carbon dioxide and other greenhouse gas emissions as close to zero as possible. Then, any remaining emissions can be balanced with an equivalent amount of carbon removal, for example, through reforestation or through technologies that capture carbon dioxide from the atmosphere.

The United Nations Framework Convention on Climate Change (UNFCCC) and its Paris Agreement set out international efforts to combat climate change and achieve carbon neutrality on a global scale, aiming to limit global warming to well below 2, preferably to 1.5 degrees Celsius, compared to pre-industrial levels.

What is net zero vs carbon neutral?

While the terms “net zero” and “carbon neutral” are often used interchangeably, there are subtle differences between them:

- Carbon Neutral focuses primarily on carbon dioxide emissions. Achieving carbon neutrality means that any CO2 released into the atmosphere is balanced by an equivalent amount being removed or offset. This can involve various strategies, including carbon offsets, renewable energy investments, and energy efficiency improvements.

- Net Zero is a broader term that encompasses not only carbon dioxide but also other greenhouse gases (GHGs) such as methane and nitrous oxide. Achieving net zero means that the total emissions of all greenhouse gases are reduced to as close to zero as possible, with any remaining emissions balanced by removing GHGs from the atmosphere. This concept is crucial for addressing climate change comprehensively since CO2 is not the only GHG contributing to global warming.

Is carbon neutrality greenwashing?

The accusation of greenwashing in the context of carbon neutrality often arises when entities claim to be carbon neutral without making significant efforts to reduce their actual carbon emissions. Instead, they might rely heavily on carbon offsets, which can sometimes be misleading or not as beneficial as they appear. For example, a company might continue polluting practices while purchasing carbon credits from a reforestation project without ensuring those trees are protected long-term.